Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

Warning of tech-bubble-like overvaluation in the IPO market, we’ve previously put recent IPO companies Wayfair, Box, and GoDaddy in the Danger Zone. This week we’re turning the tables and putting IPO investors in the Danger Zone as we reveal many of the hidden dangers of IPO investing today.

Accounting Loopholes for Pre-IPO Companies

Most investors do not know that accounting rules are different for pre-IPO companies than for post-IPO companies.

Possibly the biggest difference is in the treatment of employee stock compensation, which creates a loophole that enables companies to drastically understate option expense and overstate earnings in their pre-IPO filings. Because there is not yet an “official” value for the company’s shares, options grants are recorded at highly understated values, especially relative to IPO prices. For instance, Guidewire (GWRE) reported option expense of $6,680,000 in 2011. One year later, GWRE reported option expense of $18,258,000 after the company went public despite the number of options granted halving over the same time.

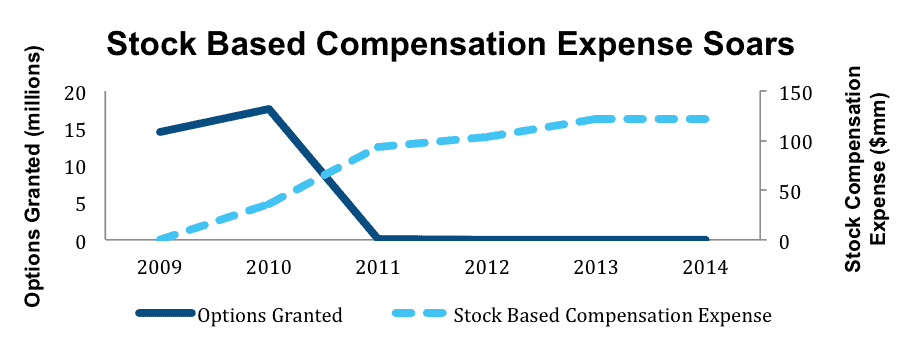

Proof of the this misleading practice manifests when, immediately following the IPO, stock compensation expense shoots off the chart as the company has to eventually recognize the more appropriate cost for the pre-IPO stock compensation. As can be seen in Figure 1, Groupon, a previous Danger Zone stock, had stock based compensation expense increase from only $115,000 in 2009, two years before its IPO to $93,000,000 in 2011 after going public. The irony here is that the number of options granted declined precipitously from 14,500,000 in 2009 to 158,000 in 2011. Meanwhile the reported accounting option expense skyrocketed.

Figure 1: Groupon Stock Based Compensation Post IPO

Sources: New Constructs, LLC and company filings

Limited And Conflicted Disclosure Is A Red Flag

Under the JOBS Act, any company with gross revenues below $1 billion is subject to less stringent reporting requirements. “Emerging growth” companies receive the following disclosure “benefits”:

1. Underwriters participating in the IPO are allowed to publish research reports and make public appearances regarding the company. Let us remind you that investment banks have a serious conflict of interest when it comes to research in general, and specifically IPO’s.

a. In 2003, 10 Wall Street banks were fined $875 million for maintaining inappropriate influence over research analysts during 1999-2001.

b. In 2012, Morgan Stanley and other underwriters profited nicely as Facebook (FB) dropped on IPO day.

c. In 2014, 10 Wall Street banks were fined a total of $43.5 million for offering favorable coverage to Toys R Us in hopes of underwriting its IPO.

2. Following the IPO, the newly public company is not required to have an independent accounting firm audit the effectiveness of the company’s internal control over financial reporting.

3. Only two years of audited financial statements (compared to three for other companies) are required to be provided to investors.

4. Only scaled executive compensation information for three executives is required and a compensation discussion & analysis is not necessary.

5. The exemption from detailed compensation disclosure continues post-IPO and the newly public company is not required to hold “say-on-pay” voting for their executive compensation arrangements.

These benefits provided to smaller companies are not benefits to investors by any stretch. Rather, they look more like benefits to underwriters. We thought reporting rules were to help investors not underwriters.

“Adjusted Earnings” Paint False Picture

We’ve previously put non-GAAP earnings in the Danger Zone, and, in a throwback to the tech-bubble days, we’re now seeing the practice of marketing non-GAAP results become more prevalent with IPO companies. GAAP earnings are not perfect, (see the 30+ adjustments we make to GAAP earnings here), and non-GAAP or pro-forma moves the focus even farther away from the cash truth. In 2014, according to Audit Analytics, 40 companies went public reporting losses under traditional accounting rules but recording profits using their own adjusted measures, which represented 19% of all U.S. IPO’s for the year. The following are just a few examples of adjusted earnings portraying companies in the best light possible.

In 2011, during the run-up to Groupon going public, the SEC requested the company remove an adjusted measurement, which Groupon called “adjusted consolidated segment operating income,” or ASCOI from its S-1. This adjusted measurement of a GAAP approved metric, consolidated segment operating income, removed acquisition costs, stock based compensation, and most importantly, subscriber acquisition expenses. Groupon’s CEO at the time defended the removal of marketing expenses related to subscriber growth because ”they are an up-front investment to acquire new subscribers that we expect to end when this period of rapid expansion concludes.” Not surprising, ASCOI showed Groupon earning $81.6 million in the first quarter of 2011 while GAAP net income showed a loss of $117 million.

We’ve previously written about the issues at Twitter and their use of adjusted EBITDA during their IPO process should have made investors think twice. Twitter reported a GAAP loss of $79 million in 2012 compared to an adjusted EBITDA of $21 million. Aside from depreciation and amortization, Twitter chose to present its adjusted EBITDA after the removal of over $25 million in stock based compensation expense. The company essentially removed the cost of paying its employees to appear profitable. Unfortunately for Twitter and early investors, business doesn’t work that way and Twitter’s share price has recently reached all time lows.

In early 2014, Zoe’s Kitchen (ZOES) received a request from the SEC much like that of Groupon above. In its S-1, Zoe’s featured its “adjusted EBITDA” in the MD&A section before providing earnings that followed standard accounting rules. Under this adjusted EBITDA, Zoe’s reported a profit of nearly $11 million in 2013 despite a GAAP net loss of nearly $4 million. In calculating adjusted EBITDA, Zoe’s removed equity based compensation, management and consulting fees, and expenses related to opening new restaurants. Much like the two examples above, Zoe’s was removing significant costs of doing business to appear profitable.

IPO Investors Don’t Care About Profits

In what may be the most saddening theme of all, it’s becoming obvious that most IPO investors don’t care whether new IPO’s even make GAAP or non-GAAP profit. As can be seen in Figure 2 below, over the past three years, we have witnessed over 60% of all IPO’s involving companies with no GAAP profits. The last time levels were this high was back in 2000, and we all remember what happened that year.

Figure 2: Percentage of IPOs Without Profits

Sources: Prof. Jay Ritter, University of Florida, New Constructs, LLC and company filings

IPO investors need to be careful. IPOs are one of Wall Street’s most profitable activities. There’s no substitute for good diligence and informed investment decisions.

New Constructs is now covering all major IPOs. We plan to publish a special report on Planet Fitness (PLNT) tomorrow. Look for more reports on IPOs from us in the future.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: LendingMemo (Flickr)