We closed this position on November 20, 2018. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Newell Rubbermaid (NWL: $33/share) is in the Danger Zone this week. NWL’s stock has doubled over the past two years as reported earnings have climbed, but after-tax profits (NOPAT) have remained flat. Nevertheless, the market’s current valuation of NWL embeds significant future profit growth.

Stagnant Profits

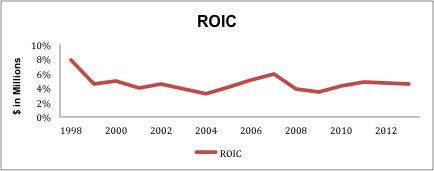

NWL has grown NOPAT by less than 1% compounded annually since 2000. NWL’s return on invested capital (ROIC) has remained consistently low for the past 13 years. It has never come close to exceeding its weighted average cost of capital (WACC).

Figure 1: Consistently Low Profitability

Sources: New Constructs, LLC and company filings.

Sources: New Constructs, LLC and company filings.

Investors just looking at reported earnings might be tempted to think that NWL has finally achieved some profit growth, as GAAP net income grew by 18% last year. However, certain non-cash items distorted GAAP net income for 2013. Most notably, decreases in reserves boosted pre-tax income by $35 million. NWL decreased its inventory reserve by roughly $20 million and its LIFO reserve by roughly $15 million.

Income from discontinued operations and non-operating tax adjustments account for the remaining distortions in reported earnings.

More Red Flags From The Footnotes

In addition to its low and stagnant profits, NWL has a couple other red flags in its filings that make it look risky. In particular, the games NWL plays with its non-GAAP earnings are more reminiscent of an unprofitable tech company than a well-established consumer goods producer. GAAP net income is an unreliable indicator of profitability, and non-GAAP earnings are even worse. When a company can make its own rules for measuring profits, they’re always going to stack the deck.

NWL’s favorite ploy has been to exclude “restructuring costs” from non-GAAP earnings on the basis that these are non-recurring costs. The only problem with this reporting is that NWL has incurred restructuring costs in each of the past 15 years. It appears that the company simply lumps any employee severance and relocation costs into restructuring, even though those are regular, recurring costs for a company with 18,000 employees.

Another big concern is the high number of asset write-downs NWL has incurred in recent years. Over the past 10 years, NWL’s accumulated asset write-downs have increased from $800 million to $1.8 billion, and its write-downs as a % of net assets now stand at 41%. Investors should not put faith in a company that has destroyed that much value.

Don’t Buy Into the Turnaround Hype

NWL is currently undergoing a restructuring initiative called the “Growth Game Plan” that promises to accelerate the company’s growth. The description of the plan is awash with vague corporate speak and obvious goals, such as “delivering products with superior performance, design and innovation.” These goals are not exactly what I would call enlightening. I mean, what was the plan before?

Investors should also be skeptical of a restructuring plan by a company that has incurred restructuring costs for 15 straight years. Surely all that restructuring should have delivered some progress by now.

There are, however, some specific strategies the company has outlined that we can analyze. The first concrete change NWL is making is to boost its spending on advertising in order to strengthen its brands and drive growth.

I’m skeptical of the actual efficacy of this plan, as NWL already spends about 5% of its revenue on advertising, higher than many of its competitors. Nor is there any indication that its advertising has been particularly effective. Despite its high advertising budget, NWL’s revenue declined by 4% in 2013, while competitor Helen of Troy (HELE) grew revenue by 2% on an advertising budget that was only 3.5% of revenue.

NWL’s other big strategic initiative is to expand internationally, first in Latin America and then in Asia. While international expansion is a big opportunity, it also involves significant risks. NWL learned this first hand in the first quarter of 2014 when significant currency fluctuations decreased its year-over-year revenue in both Latin America and Asia.

More importantly, I’m skeptical of NWL’s ability to successfully compete internationally. In the U.S., where NWL has strong, well-known brands, it can continue to compete, but internationally its low capital efficiency should put it at a big disadvantage. Figure 2 shows that NWL’s ROIC and Invested Capital Turns compare unfavorably to many of its competitors.

Figure 2: Low Capital Efficiency

Sources: New Constructs, LLC and company filings.

Sources: New Constructs, LLC and company filings.

NWL’s inferior capital efficiency suggests that the company is not good at expansion. Low capital turns mean they get less revenue out of capital than they should. This weakness suggests that the company will not get adequate returns on the capital it will have to deploy to expand internationally.

Meanwhile, NWL has to worry that product issues such as the recently announced recall of its Graco car seats could harm its one big advantage, its strong brands.

Valuation is Out of Touch With Reality

If NWL’s operational struggles were the only problem this would not necessarily be in the Danger Zone. NWL’s lofty valuation makes it truly dangerous.

In order to justify its current valuation of ~$33/share, NWL would need to grow NOPAT by 10% compounded annually for 16 years. Remember, this is a company that has grown NOPAT by less than 1% compounded annually for the past 13 years.

A more reasonable, but still optimistic, scenario of 4% compounded annual NOPAT growth for 15 years yields a fair value of just under $20/share. Given NWL’s track record of low profit growth and the pressure that its key writing segment faces from our increasingly paperless society, even 4% NOPAT growth seems like a bit of a stretch.

Insiders Are Selling and So Should You

Over the past year, NWL insiders have sold nearly 900,000 shares, roughly seven times the number they’ve bought. Insider selling on its own is not a reason to be bearish, but it raises some questions about confidence within the company.

Investors have a tendency to fall into what I call the sector theme trap, where they invest in stocks based on the sector they are in. In the case of NWL, investors seem to be under the mistaken conclusion that this is a safe value stock since it sells durable consumer goods, but that does not appear to be the case. NWL is a dangerous, overvalued stock that investors should avoid.

Sam McBride contributed to this report.

Disclosure: David Trainer is short NWL. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Feature photo credit: Rubbermaid Products (Flickr)

1 Response to "Danger Zone: Newell Rubbermaid (NWL)"

NWL down ~20% as 4Q18 sales miss expectations. Now down over 45% since the Danger Zone report above while the S&P is up 40%.