For the week of 3/30/20-4/3/20, we focus on the Earnings Distortion Scores for 16 companies.

Our proprietary measure of earnings distortion (as featured on CNBC Squawk Box) leverages cutting-edge ML technology featured in Core Earnings: New Data & Evidence. This paper empirically concludes that our adjusted core earnings are superior to:

- “Street Earnings” from Refinitiv’s IBES, owned by Blackstone (BX) and Thomson Reuters (TRI), and

- “Income Before Special Items” from Compustat, owned by S&P Global (SPGI

The paper also shows that investors with better earnings research have a clear advantage in predicting:

- Future earnings (Section 3.4)

- Future stock prices (Section 4.3)

Our Earnings Distortion Scores[1] empower investors to make smarter investments with superior data as well as defend against management efforts to obfuscate financial performance. Earnings distortion for the overall market recently reached levels not seen since right before the tech bubble and the financial crisis.

Weekly Earnings Distortion Insights

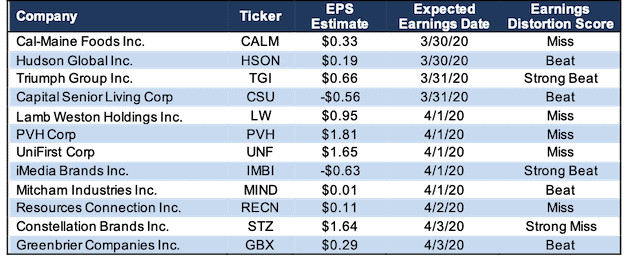

Figure 1 contains the 12 largest (by market cap) companies that earn a “Strong Beat”, “Beat”, “Miss”, or “Strong Miss” Earnings Distortion Score and are expected to report the week of March 30, 2020.

Figure 1: Earnings Distortion Scorecard Highlights: Week of 3/30/20-4/3/20

Sources: New Constructs, LLC and company filings

The appendix shows the Earnings Distortion Scores for all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of March 30, 2020.

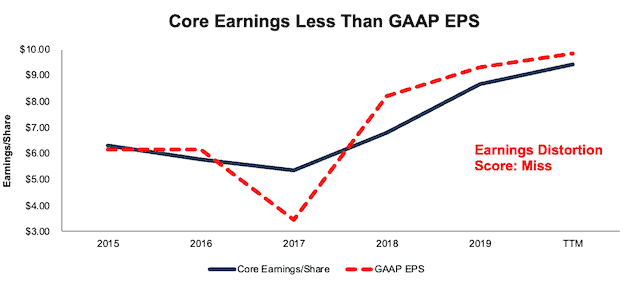

Details: UniFirst Corporation’s (UNF) Earnings Distortion

Over the trailing twelve months (TTM), UniFirst Corporation (UNF) has $8 million in net earnings distortion that cause earnings to be overstated. Notable unusual income hidden in UNF’s 2019 10-K includes:

- $21 million in gains related to a settlement agreement that reduced selling and administrative expense – Page 63

This unusual income is partially offset by $7 million in one-time bonuses paid to employees disclosed on page 72.

In total, we identified $0.44/share (4% of GAAP EPS) in net unusual income in UNF’s TTM GAAP results. After removing this earnings distortion, UNF’s TTM core earnings of $9.43/share are lower than GAAP EPS of $9.87, per Figure 2.

Accordingly, UNF gets our “Miss” Earnings Distortion Score and is likely to miss consensus expectations.

Figure 2: UNF Core Earnings Vs. GAAP: 2015 – TTM

Sources: New Constructs, LLC and company filings

Figure 1 shows that UNF is one of six companies that earn our “Miss” or “Strong Miss” rating for this week.

How to Make Money with Earnings Distortion Data

“Trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 7-to-10% per year.” – Page 1 in Core Earnings: New Data & Evidence

In Section 4.3, professors from HBS & MIT Sloan present a long/short strategy that holds the stocks with the most understated EPS and shorts the stocks with the most overstated earnings.

This strategy produced abnormal returns of 7-to-10% a year. Click here for more details on our data offerings.

We Provide 100% Audit-ability & Transparency

Clients can audit all of the unusual items used in our calculations in the Marked-Up Filings section of each of our Company Valuation models. We are 100% transparent about what goes into our research because we want investors to trust our work and see how much goes into building the best earnings quality and valuation models.

This article originally published on March 23, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

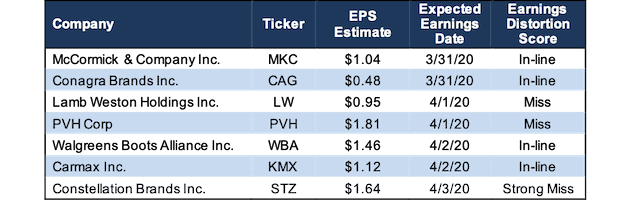

Appendix: All Major Companies Expected to Report March 30- April 3

Figure 3 shows all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of March 30, 2020.

Figure 3: Earnings Distortion Scorecard: Week of 3/30/20-4/3/20

Sources: New Constructs, LLC and company filings

[1] Earnings Distortion scores on ~3,0000 stocks are also available to clients of our website.