For February 22, 2018, our forensic accounting red flag is from a specialty retailer with off-balance sheet debt and an unusual tax impact.

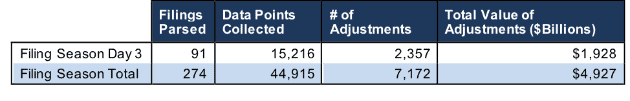

We pulled this highlight from yesterday’s research of 91 10-K filings, from which our Robo-Analyst technology collected 15,216 data points. Our analyst team used this data to make 2,357 forensic accounting adjustments with a dollar value of $1.9 trillion. The adjustments were applied as follows:

- 1,053 income statement adjustments with a total value of $102 billion

- 920 balance sheet adjustments with a total value of $1.2 trillion

- 384 valuation adjustments with a total value of $658 billion

Figure 1: Filing Season Diligence for Thursday, February 22nd

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to materially superior models and metrics.

Today’s Forensic Accounting Needle in a Haystack Is for Specialty Retailer Investors

The Robo-Analyst found an unusual item yesterday in Tile Shop Holdings’ (TTS) 10-K.

On page 73, TTS disclosed $581 million in future operating lease obligations. Discounted to their present value, these operating leases represent $384 million in off-balance sheet debt, 65% of TTS’s invested capital and 142% of total assets. That’s right, the majority of the capital TTS uses to fund its business does not even show up on the balance sheet (although the FASB will require these leases to be held on the balance sheet beginning in 2019).

Our technology identified, discounted, and incorporated these leases into our model without the need for any human intervention. By automating this simple task, the machine freed up analyst Hunter Anderson to interpret more unusual items. For instance, on page 78, TTS disclosed a $4.6 million tax charge due to the remeasurement of its deferred tax assets as a result of the new tax law. By accounting for this unusual item, we determined that the company’s true cash tax rate was 39% rather than its reported 55%. This adjustment increases after-tax cash flow (NOPAT) by 18%.

This article originally published on February 23, 2018.

Disclosure: David Trainer, Hunter Anderson, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.