For February 26, 2018, our forensic accounting red flag is a tire company with a significant change to accounting policy.

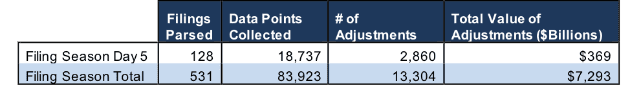

We pulled this highlight from yesterday’s research of 128 10-K filings, from which our Robo-Analyst technology collected 18,737 data points. Our analyst team used this data to make 2,860 forensic accounting adjustments with a dollar value of $369 billion. The adjustments were applied as follows:

- 1,227 income statement adjustments with a total value of $24 billion

- 1,164 balance sheet adjustments with a total value of $152 billion

- 469 valuation adjustments with a total value of $192 billion

Figure 1: Filing Season Diligence for Monday, February 26th

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to meaningfully superior models and metrics.

Today’s Forensic Accounting Needle in a Haystack Is for Auto Industry Investors

Analyst Hunter Anderson found an unusual item yesterday in Titan International’s (TWI) 10-K.

On page 9 of the footnotes (page 54 overall), TWI disclosed that it changed the inventory accounting at subsidiary Titan Wheel Corporation of Illinois from LIFO (Last In First Out) to FIFO (First In First Out). This change not only impacted TWI’s inventory and cost of sales in 2017, it also caused the company to go back and restate its results from the prior two years, which increased cost of sales by $3.6 million in 2016 and $3.1 million in 2015.

Fortunately, this restatement does not impact our models, as we already adjusted for TWI’s LIFO reserves (the difference a company discloses between their LIFO accounting and what inventory would be using FIFO). This adjustment allows us to use FIFO for all companies, ensuring comparability between different firms and different time periods.

This article originally published on February 27, 2018.

Disclosure: David Trainer, Hunter Anderson, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.