Our latest featured stock is a regional bank with misleading earnings growth.

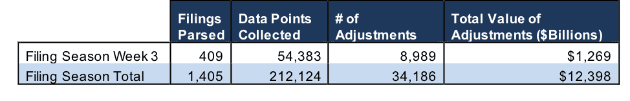

We pulled this highlight from last week’s research of 409 10-K filings, from which our Robo-Analyst technology collected 54,383 data points. Our analyst team used this data to make 8,989 forensic accounting adjustments with a dollar value of $1.3 trillion. The adjustments were applied as follows:

- 3,837 income statement adjustments with a total value of $99 billion

- 3,693 balance sheet adjustments with a total value of $513 billion

- 1,459 valuation adjustments with a total value of $657 billion

Figure 1: Filing Season Diligence for Week of March 5-10

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate robust financial modeling.

A Fiduciary Level of Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to materially superior models and metrics.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can advisors go beyond the suitability standard and provide a fiduciary level of service to their clients.

One Company to Watch in 2018

Based on our analysis of PacWest Bancorp’s (PACW) 2017 10-K, we put the company in our Most Dangerous Stocks Model Portfolio. Analyst Eric Roll identified two significant red flags.

On the balance sheet, PACW reported an $18 million (5% of net income) decrease to its loan and lease loss allowance. Notably, PACW’s gross loans and leases increased by 10% in 2017, so the company is assuming lower losses on a larger portfolio of loans and leases.

On page 56, PACW discloses that it earned $8 million (2% of net income) from legal settlements with former borrowers and other parties.

PACW’s GAAP net income increased by 2% in 2017, but our adjustments reveal that after-tax operating profit (NOPAT) actually declined by 12%.

In total, we made the following adjustments to PacWest Bancorp’s 2017 10-K:

Income Statement: we made $68 million of adjustments, with a net effect of removing $6 million in non-operating income. We removed $37 million in non-operating income and $31 million in non-operating expense. Outside of the adjustments listed above, our largest adjustment was a non-operating tax adjustment that reduced NOPAT by $12 million (including a $1.2 million decrease due to a one-time benefit from tax reform). You can see all the adjustments made to PACW’s income statement here.

Balance Sheet: we made $1.1 billion of adjustments to calculate invested capital with a net increase of $1.1 billion (22% of reported net assets). Aside from the credit loss allowance referenced above, our largest adjustment was to add back $818 million in accumulated asset write-downs. You can see all the adjustments made to PACW’s balance sheet here.

Valuation: we made $133 million of adjustments with a net effect of decreasing shareholder value by $133 million. The largest adjustment to shareholder value was $130 million in off-balance sheet debt. This adjustment represents 2% of PACW’s market cap.

This article originally published on March 12, 2018.

Disclosure: David Trainer, Eric Roll, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.