Finding the best mutual funds is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

You Cannot Trust Mutual Fund Labels

There are at least 933 different Large Cap Value mutual funds and at least 6387 mutual funds across all styles. Do investors need that many choices? How different can the mutual funds be?

Those 933 Large Cap Value mutual funds are very different. With anywhere from 8 to 1013 holdings, many of these Large Cap Value mutual funds have drastically different portfolios, creating drastically different investment implications.

The same is true for the mutual funds in any other style, as each offers a very different mix of good and bad stocks. The Large Cap Blend style ranks first. Small Cap Blend ranks last. Details on the Best & Worst mutual funds in each style are here.

A Recipe for Paralysis By Analysis

We firmly believe mutual funds for a given style should not all be that different. We think the large number of Large Cap Value (or any other) style of mutual funds hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many mutual funds. Analyzing mutual funds, done with the proper diligence, is far more difficult than analyzing stocks because it means analyzing all the stocks within each mutual fund. As stated above, that can be as many as 1013 stocks, and sometimes even more, for one mutual fund.

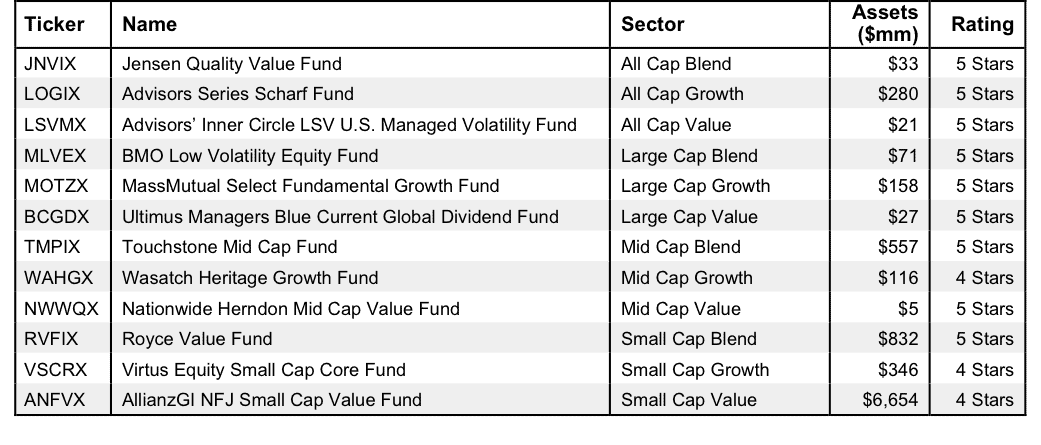

Any investor worth his or her salt recognizes that analyzing the holdings of a mutual fund is critical to finding the best mutual fund. Figure 1 shows our top-rated mutual fund for each style.

Figure 1: The Best Mutual Fund in Each Style

Sources: New Constructs, LLC and company filings

How to Avoid “The Danger Within”

Why do you need to know the holdings of mutual funds before you buy?

You need to be sure you do not buy a fund that might blow up. Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. No matter how cheap, if it holds bad stocks, the mutual fund’s performance will be bad.

PERFORMANCE OF FUND’S HOLDINGS = PERFORMANCE OF FUND

If Only Investors Could Find Funds Rated by Their Holdings…

New Constructs covers over 3000 stocks and is known for the due diligence we do for each stock we cover. Accordingly, our coverage of mutual funds leverages the diligence we do on each stock by rating mutual funds based on the aggregated ratings of the stocks each mutual fund holds.

Ultimus Managers Blue Current Global Dividend Fund (BCGDX) is the top-rated Large Cap Value mutual fund and the overall top fund of the 6387 style mutual funds that we cover.

To see ratings on all the mutual funds we cover, start your Gold Membership today.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Photo Credit: Thinkpanama (Flickr)