Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

The semiconductor industry continues to grow rapidly and there are new uses emerging for these products on an almost daily basis. But not all semiconductor stocks are the same. This week we’re focusing on a company that is struggling to survive in this competitive industry: Intersil Corporation (ISIL: $14/share)

Intersil designs and develops power management and precision analog integrated circuits. The company offers power integrated circuit chips for battery management, processor power management, and display power management. Intersil’s products can be divided into industrial and infrastructure products (64% of revenue), consumer products (16% of revenue), and computing products (21% of revenue).

Growth is Long Gone

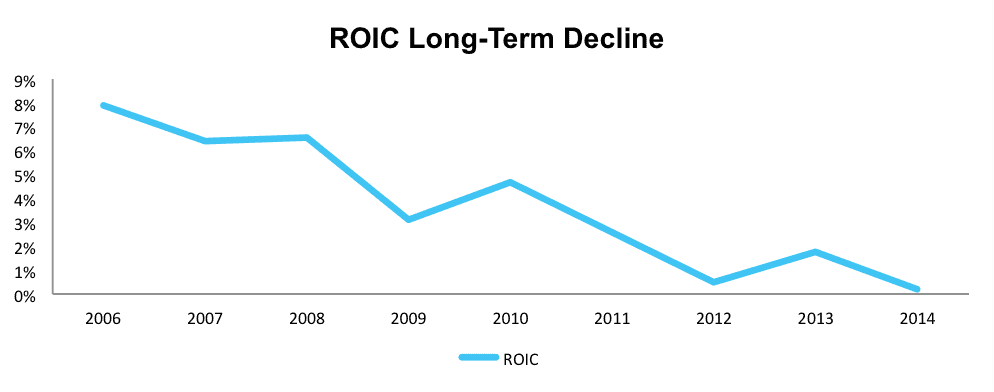

Intersil, which went public in early 2000, is a tech bubble company still struggling to find its way. It should be noted that the company grew after-tax cash flow (NOPAT) from -$34 million to $141 million and return on invested capital (ROIC) from -6% to 8% from 2001 to 2006 — certainly an impressive feat. Since 2006, however, the company has entered a downward spiral, and the stock, while down 45% since 2006, still has a lot of room to fall.

Since 2006, NOPAT has declined by 30% compounded annually while ROIC has fallen from the aforementioned 8% to just 0% in 2014.

Figure 1 shows Intersil’s long-term downward trend in profitability:

Figure 1: No Growth, No Profitability

Sources: New Constructs, LLC and company filings.

We think the main reason for the past decline in Intersil’s profitability is its fluctuating strategy. In 2003, the company divested its wireless business and switched its focus to becoming a high performance analog and mixed signal company by acquiring Elantec in 2002. Since then, Intersil has acquired eight other businesses in the segment, each with the aim of strengthening the new core business. This reckless acquisition strategy led to Intersil having over 60 different product lines meeting any number of clients’ needs.

This strategy proved to be a losing one, and Intersil again switched focus in 2013 to integrated power management and precision analog integrated circuits. Its goal is to market its entire portfolio of integrated circuit products to industrial and infrastructure markets, mobile markets, and automotive and aerospace markets. However, Intersil’s shifting strategies have resulted in five consecutive years of revenue decline. This decline is continuing into 2015, as Intersil reported a revenue decline of 4% year over year in 1Q15.

Intersil’s pretax margins over the past five years have fallen from 17% to 6% in 2014. Economic earnings have also been negative every year since IPO, indicating that Intersil has yet to generate any true value for its shareholders.

These Adjustments Reveal Intersil’s Recurring Profitability

To reveal how Intersil reported net income growth from $2 million in 2013 to $54 million in 2014, we must look deeper into the company’s 10-K.

In 2013, the company understated earnings by taking some unusual charges to set up for a good comp in 2014:

- Nearly $29 million in non-recurring restructuring charges

- $6 million in provisions for a one-time compliance settlement

Removing these one-time non-operating expenses revealed that Intersil’s 2013 profit was much higher: a NOPAT of $35 million versus reported net income of just $2 million

Conversely, 2014’s NOPAT was much lower than Intersil’s reported net income of $54 million.

In 2014, Intersil failed to disclose any inventory reserves in section “Schedule II” on page 66 of its 10-K. In 2013, the company reported inventory reserves at $47 million. The lack of disclosure is odd given that Intersil has reported an inventory reserve on every 10-K dating back to 2001.

We removed this “change” in inventory reserves from net income, revealing a 2014 NOPAT of only $8 million, well below the company’s reported $54 million GAAP net income.

Weak Competitor, Less Resources

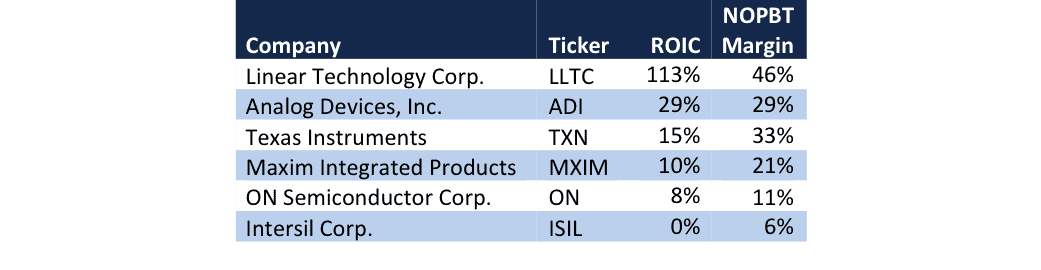

Intersil competes with other large analog integrated circuit manufacturers such as Linear Technology Corp (LLTC), Analog Devices (ADI), Texas Instruments (TXN), and others. Figure 2 shows how Intersil stacks up with this competition in terms of ROIC and profit margins:

Figure 2: At the Bottom of the industry

Sources: New Constructs, LLC and company filings.

Note that Intersil is at the bottom of the list in terms of ROIC with a paltry 0%. The second thing to note is just how poor Intersil’s pre tax margins are compared to other industry competitors. How can Intersil compete when it has margins already significantly below those of its competitors?

Valuation Ignores Current State of the Business

Despite the poor health of its business, Intersil’s stock price is up over 71% in the past two years. This appreciation has led the stock to become extremely overvalued.

To justify its current valuation of $13/share, Intersil would need to grow NOPAT by over 24% compounded annually for the next 28 years.

Seeing as Intersil’s profits have declined by 45% compounded annually since 2010 we think this level of solid, sustained growth is unlikely. Similarly, since 2001, Intersil has not seen sustained NOPAT growth for even two consecutive years, yet the company’s valuation implies nearly three decades of sustained growth.

If Intersil can instead grow profits by an overly optimistic 12% compounded annually for the next 15 years, the stock is worth $3/share, a 74% downside from current levels.

Dividend is Costly

Intersil currently offers a small $0.48 annual dividend, which represents a 3.6% yield, and with over 131 million shares outstanding, uses up over $62 million in capital.

These Catalysts Make ISIL Far Too Dangerous

The first potential threat to ISIL’s stock price is further litigation issues. Intersil was ruled to have infringed on certain patents, and to have breached contract and misappropriated trade secrets in early 2015. The jury ruled that the company must pay $59 million, and ISIL is setting aside $80 million in provisions for any future settlements in this case. The semiconductor industry is filled with patent litigation and any rulings like this will only further hurt the company’s financial position.

The second catalyst comes from Intersil’s competitors, which have significantly more resources than Intersil. This leaves little room for error in relation to Intersil, as opportunities are more valuable and mistakes more costly for the company.

Insiders Not Selling, But Also Not Buying

In the past six months, insiders have bought zero shares and sold 5,417 shares, representing less than 1% of net shares sold.

Short Interest

Short interest stands at 4.8 million shares, or nearly 4% of shares outstanding.

Stupid Money Risk

With a market cap of only $1.8 billion and no long term debt, along with the hot acquisition climate in the semiconductor industry, Intersil could be a takeover target, making a short of this company risky.

Executive Compensation

In addition to their annual salary, Intersil’s executives have a short-term bonus as well as a long-term compensation plan. Short-term bonuses are cash distributions paid to executives upon the company meeting desired operating margin, gross margin, or revenue performance goals.

The long-term compensation plans on the other hand consist of a performance-based market stock unit program, time based stock options, and deferred stock units. The performance based plan is tied directly to ISIL’s stock price return relative to the S&P Semiconductor Select Index. If the stock return ranks within the 50th percentile of the peer group, executives receive 100% of the planned equity compensation. Similarly, stock options and deferred stock units are given and grow in value as the ISIL’s price increases, further incentivizing executives to ensure the stock price grows by any means necessary.

Dangerous Funds That Hold ISIL

The following ETFs and mutual funds allocate significantly to ISIL and earn our Dangerous or Very Dangerous ratings.

- Advisor Series Poplar Forest Partners Fund (PFPFX) — 2.9% allocation to ISIL and Dangerous Rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo Credit: Windell Oskay (Flickr)