Are You Missing Something in Your Company Valuations?

Accounting rules make it easy for companies to manipulate traditional measures of profitability and value. That’s why we make over 30 types of accounting adjustments to strip out the effects of these accounting policies.

Several of these adjustments help us accurately calculate economic book value (EBV) and shareholder value in our discounted cash flow model. EBV is our measure of the no-growth value of a stock based on the current net operating profit after tax (NOPAT) of the business, and it helps us measure the market’s expectations relative to the company’s current economic profitability. Shareholder value is the value available to shareholders in our DCF model after other, senior claims on cash flows have been met.

Some adjustments represent senior claims to equity holders that reduce economic book value and shareholder value while others are assets that we expect to be accretive to shareholder value. For example, Tesla (TLSA), instead of paying employees in cash, elects to pay much of its compensation in the form of stock options, which amounted to $553 million at the end of 2012. Of course, after the stock’s historic run-up over 2013 and 2014, these options were worth much, much more. By the end of 2014, the value of Tesla’s outstanding stock options had reached $4.1 billion, or 15% of the company’s total market value. These options represent future share dilution that reduce the cash flows that are paid out to shareholders, which reduces Tesla’s value in our model. As Tesla has failed to become a cash machine in the past 12 months, investors have begun to worry about the company’s position, and shares have dropped over 33% since their peak in September 2014.

There are countless other examples of how footnotes diligence could have given investors a clear picture of what companies were worth investing money into in 2014.

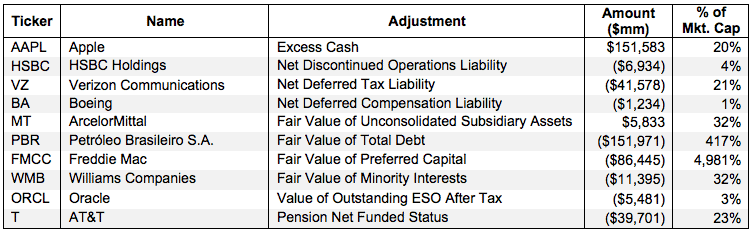

We’ve compiled a “top 10″ list of the companies (who have already filed for 2014) with the largest adjustments to their valuations.

The following presents the companies with the largest individual adjustments across each of the 10 different adjustments we make to companies’ economic book value and discounted cash flow models:

Apple (AAPL) — $151.6 Billion in Excess Cash

Excess cash is the cash a business carries beyond what is required for its normal operations. For most businesses, we estimate this required amount to be around 5% of sales. This surplus liquid capital can be used for any number of purposes, such as acquisitions or research and development. Because excess cash is also immediately available for distribution to shareholders, we add this surplus to our calculation of shareholder value. Apple had an amazing $152 billion in excess cash at the end of 2014 — more than the market values of 475 companies in the S&P 500. Apple can use this amount to further its research and development, or to pay out to shareholders in the form of buybacks or dividends. As such, we add this amount to our calculation of EBV and shareholder value.

HSBC Holdings (HSBC) — -$6.9 Billion in Net Discontinued Operations Liabilities

Discontinued operations are parts of a business that are classified as being held for sale. We calculate the value of the net assets of the unit being held for sale, and add (if a net asset) or subtract (if a net liability) the resulting amount from our calculations of economic book value and shareholder value. The net asset/liability approximates the cash the company will receive from the sale of the discontinued unit. This cash will then be available (or not be available) for distribution to shareholders. In 2014, HSBC recorded net liabilities of $6.9 billion in the sale of its UK pensions business, calculated as carrying or fair value minus cost to sell. Because HSBC expects to record a loss on this sale, we subtract this net liability from our calculations of EBV and shareholder value.

Verizon Communications (VZ) — -$41.6 Billion in Net Deferred Tax Liabilities

Deferred tax assets (DTAs) arise when reported income on a financial statement is less than taxable income. DTAs are, in a sense, like pre-paid taxes and represent expected reductions of future reported taxes. Deferred tax liabilities (DTLs), on the other hand, arise when reported income is greater than taxable income. DTLs represent the expected amount of additional reported taxes to be paid. These items are a result of differences between GAAP accounting and tax policy. Things that cause DTAs include product warranty reserves and tax loss carry-forwards. Verizon had a net DTL of almost $42 billion in 2014, the result of accelerated depreciation on its wireless licenses and its network that lowered its tax bill relative to its reported income. This $42 billion represents a real cash obligation to the federal government that must one day be paid, so we subtract this amount from our calculation of EBV and shareholder value.

Boeing (BA) — -$1.2 Billion in Net Deferred Compensation Liabilities

Deferred compensation assets arise when companies and employees agree to defer compensation until a later date. The company then holds assets in a trust to pay out later to its employees. Often, there is a significant difference between the assets in these trusts and the future obligations required in the deferred compensation plans. If the assets are greater than these obligations, we add the net asset to shareholder value. In the case of a net asset, any future increases in the obligation will not need to be met with new funding, and that cash can be used to pay out to shareholders instead. If the obligations are greater than the assets in the trust, we subtract the resultant net liability from shareholder value, as future cash flows will need to be diverted to pay for that obligation. Boeing’s deferred compensation plan was underfunded by over $1.2 billion dollars in 2014. This amount will eventually need to be paid to workers, and we subtract this cash obligation from our calculations of EBV and shareholder value.

ArcelorMittal (MT) — $5.8 Billion in Unconsolidated Subsidiary Assets

When a company has significant control in a subsidiary, the parent company’s equity stake in the subsidiary appears on the balance sheet, but the subsidiary’s financial statements are not consolidated into the parent company’s statements. If we cannot determine the subsidiary’s impact on the parent company’s profits, we exclude the subsidiary’s income from NOPAT and its assets from invested capital. We then treat the assets in the unconsolidated subsidiary like cash and add them to shareholder value as we do excess cash. ArcelorMittal had over $5.8 billion in investments in its joint and associate mining operations around the globe. These equity stakes can be sold off for their fair value, so we add these liquid assets to our calculations of EBV and shareholder value.

Petróleo Brasileiro (PBR) — -$152.0 Billion in Total Debt

Adjusted total debt is the fair value of a company’s total short-term, long-term, and off-balance sheet debt. We use the fair value of a company’s total debt in our models because it is a better representation of a company’s current and future obligations than the book value of debt reported on the balance sheet. The fair value of a company’s total debt is the current amount the company would need to pay to retire its debt and settle the claims of its creditors. Petróleo Brasileiro or “Petrobras” has $152 billion in total debt, which is inclusive of $37 billion in off-balance sheet debt in the form of operating leases. This $152 billion is subtracted from shareholder value and economic book value because the firm would need to settle these claims before it could return any cash to shareholders.

Freddie Mac (FMCC) — -$86.4 Billion in Preferred Capital

Preferred stock is a hybrid instrument that carries no voting rights but has a senior claim on assets and cash flows to common stock. Dividends usually must be paid out to preferred stock owners before common stock owners can receive any money. In the event of liquidation, preferred shareholders also have priority. Many preferred shares also come with an option to convert into multiple basic shares at any time, making them a potential source of dilution. Freddie Mac (and Fannie Mae (FNMA)) has billions of dollars worth of preferred stock held by the U.S. government due to its bailout in 2008. Any common equity investment in FMCC is purely speculative at the moment as all of its profits flow directly into the U.S. Treasury. Freddie Mac has over $86 billion in preferred stock, $72 billion of which is “senior preferred” and held by the Treasury. Common shareholders have no rights to any of the profits unless the government relinquishes its senior preferred stock. We subtract the value of this capital from Freddie Mac’s EBV and shareholder value, as it decreases the capital available to common shareholders.

Williams Companies (WMB) — -$11.4 Billion in Minority Interests

Minority interests (or non-controlling interests) are a significant but non-controlling ownership of another company voting shares. The portion of the parent company’s income attributed to the minority interests (recorded as minority interest expense) is subtracted from reported profits. The parent company’s balance sheet will also show a liability for the minority interest. Williams Companies had over $11 billion in minority interests in 2014, mainly due to its 49% interest in Access Midstream Partners (ACMP) prior to the two companies’ merger in Feb. 2015. We subtract the fair value of the minority interest liability from EBV and shareholder value as the minority interest shareholders have the rights to that portion of the cash flows.

Oracle (ORCL) — -$5.5 Billion in Outstanding Employee Stock Option Liabilities

Employee stock options (ESOs) are a liability based on future share dilution as employees exercise their options and add to the total number of shares outstanding. Companies with rapid appreciation in their stock prices can be especially susceptible to having high outstanding ESO liabilities as options granted at a cheap price quickly become much more valuable. As of 2014, Oracle has granted its employees stock options now valued at $5.5 billion. Using the Black-Scholes model, we account for the fair value of all of Oracle’s outstanding employee stock options and subtract this value from our EBV and shareholder value calculations.

AT&T (T) — -$39.7 Billion in Underfunded Pensions

Companies disclose 1) the value of the assets used to fund their pension plans and 2) the present value of the future obligation, called the projected benefit obligation. The net funded status of a pension plan is the difference between these two values. A company with a positive net funded status has more assets than it needs in its plan, which means future cash flows that would have been used to meet new obligations are instead available to shareholders. Companies with underfunded pensions will likely need to divert a greater amount of future cash flows away from shareholders to make up the funding gap. This type of adjustment is similar to the one we make for deferred compensation plans, discussed above. In 2014, AT&T disclosed that its pension was underfunded by almost $40 billion dollars. We subtract this amount from AT&T’s EBV and shareholder value calculations, as $40 billion in cash flows will need to be used to fund this plan instead of being paid out of shareholders.

If you liked this report, get more free research by signing up below

Due Diligence Done Right

We’re focused on getting to the bottom of earnings numbers. Analyzing the footnotes and MD&A is the only way to get a clear picture of a company. We read the fine print so you don’t have to.