The search for quality stocks only gets harder as companies use a growing array of tricks to deceive investors. Our research has always focused on cutting through the noise. We focus on gathering quantifiable facts to identity good risk/reward opportunities for clients. This week’s Long Idea, Allegiant Travel Company (ALGT: $185/share) has shown consistent profit growth throughout its history. It also has a unique business model that provides competitive advantages that its stock price does not reflect.

A Long-Term History of Profit Growth

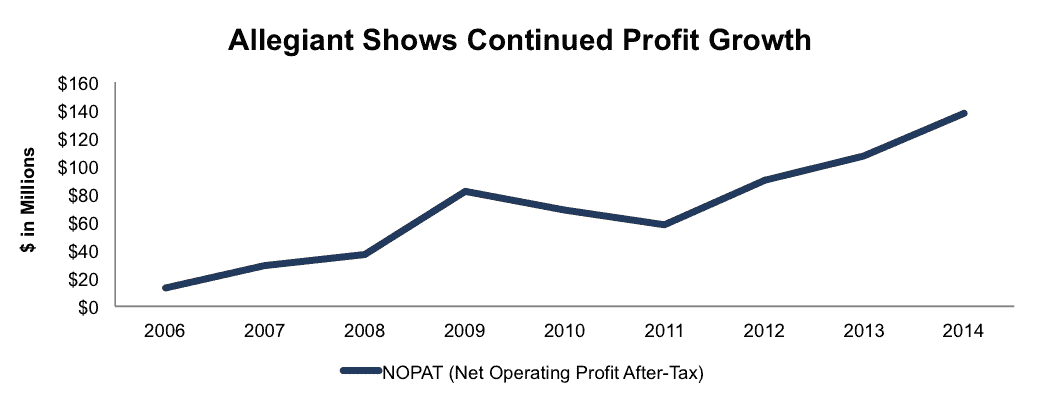

Allegiant Travel Company finds itself on this month’s Most Attractive Stocks list in part because of its consistent profit growth. Allegiant has grown after-tax profit (NOPAT) by an impressive 34% compounded annually since 2006.

Figure 1: Strong Business Getting Stronger

Sources: New Constructs, LLC and company filings

With a top quintile return on invested capital (ROIC) of 27%, Allegiant’s unique business model, catering to leisure travelers in underserved locales, has been executed with excellent efficiency. ROIC was just 11% in 2006. NOPAT margins have improved to 16% on a trailing-twelve-month basis, up from 5% in 2006.

Serving A Niche Market Has Lead To Superior Profitability

Allegiant has built a strong business with a strategy that fills the gaps in the large airline companies’ offerings. Allegiant focuses on leisure travelers, not business, and only flies non-stop from locations where the company has little competition on its routes. As Figure 2 shows, with its 27% ROIC, Allegiant operates in this market more profitability than its larger competitors who are more focused on high frequency routes to large cities. In fact, Allegiant’s 27% ROIC is the highest, by a wide margin, of all 13 airline companies under coverage.

Figure 2: Allegiant’s Profitability Is Top In Its Industry

Sources: New Constructs, LLC and company filings.

Bear Concerns Are Unjustified

A common fear among small airlines is that the larger competitors will eventually squeeze them out of business with pricing tactics. As a result of this fear, many investors are weary of Allegiant’s ability to continue operating as successfully as they have done in the past. This fear is certainly true of traditional small airlines that compete directly with the mainline providers; however, Allegiant’s business model affords it a competitive advantage that changes this narrative. By serving underserved and small cities, Allegiant faced mainline competition on only 24 of their 229 routes in 2014. The locations Allegiant serves would be unprofitable for larger competitors with their larger planes that would incur greater operating costs.

Additionally, Allegiant’s scheduling flexibility is something that other airlines cannot afford to offer. Allegiant regularly has days where no planes are used in a particular location, while other days of the week every single plane in the fleet is in operation. This flexibility allows Allegiant to maximize the revenue per seat and only fly when demand is expected to be strongest, unlike large competitors who often fly a set schedule regardless of demand.

Another bear concern revolves around claims that Allegiant’s aircraft are poorly maintained and less safe. This was a major claim made by Teamsters, an airline union, amidst threats of a pilots strike. Allegiant responded to the claims as simply scare tactics. It appears Allegiant has a point. Per AirlineRatings.com, Allegiant holds a safety rating of 5/7 stars, equal to that of competitors Southwest, Spirit Airlines, and Frontier. It would appear Allegiant’s safety rating should not provide more fuel for bears’ fire.

Share Price Is Significantly Undervalued

Despite the strength of Allegiant’s business, the stock is down over 17% in the last three months. This price decline has created a great buying opportunity. At its current price of $185/share, Allegiant has a price to economic book value (PEBV) ratio of 1.2. This ratio means that the market expects Allegiant to grow its NOPAT by only 20% for the remainder of its corporate life. This expectation seems to overlook the fact that Allegiant has grown NOPAT by 34% compounded annually since 2006.

If Allegiant can grow NOPAT by just 11% compounded annually for the next decade, the stock is worth $257/share today – a 39% upside.

Share Buybacks and Dividend Provide Quality Yield

Allegiant’s current $100 million stock repurchase plan, which was approved in July 2015, has $62 million remaining as of 3Q15. This authorization has been continually increased as Allegiant has exhausted it in previous years. In fact, Allegiant repurchased $139 million in 2014 (a yield of 5.1% based on market cap at end of 2014) and has repurchased $119 million (a yield of 3.7%) year-to-date. If the company maintains $120 million per year in share repurchases, it offers investors a 4.4% yield when combined with Allegiant’s dividend, not including special dividends.

Improving Economy Will Spur Earnings Beat

Continued economic improvement could spur Allegiant to new highs. Because it operates as a leisure airline, it is dependent upon a strong consumer to continue growing profits. As we have seen lately, the economy continues its slowly trek upwards, unemployment continues moving downward, and consumer confidence remains near its highest level in almost two years. These factors all add up to the potential for increased airline usage, and with prudent management of its service routes, Allegiant could be in store for a earnings beat in the near term, as well as long-term continued profit growth.

Another catalyst unrelated to a strong consumer could be the settlement or agreement between Allegiant and its pilots union. Either of these options could send shares higher.

Insider Trends/ Short Sales Raise No Red Flags

Over the past 12 months, insiders have purchased ~13,000 shares and sold ~47,000 shares for a net effect of ~34,000 insider shares sold. This amount represents less than 1% of shares outstanding. Additionally, short interest sits at just ~700,000, or just above 4% of shares outstanding.

Executive Compensation Passes The Test

Allegiant Travel’s executive compensation could be improved by focusing on ROIC, which better measures shareholder value creation. In its current form, Allegiant’s executive compensation plan awards executives equity and cash bonuses only if operating income exceeds 5% of revenue. In the event awards are given, the total bonus pool will not exceed 10% of operating income. Besides operating income targets, the executive compensation is at the discretion of the compensation committee. While this means manipulated metrics such as EPS are not used, we would still prefer more objective measures, such as ROIC, to determine executive compensation.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Allegiant’s 2014 10-K. The adjustments are:

Income Statement: we made $114 million adjustments with a net effect of removing $52 million (4% of revenue) of non-operating expenses. We removed $31 million in non-operating income and $83 million in non-operating expenses.

Balance Sheet: we made $581 million of balance sheet adjustments to calculate invested capital with a net decrease of $341 million. The largest adjustment made was the removal of $93 million due to midyear acquisitions. This adjustment represented 11% of reported net assets.

Valuation: we made $1 billion of shareholder value adjustments with a net decrease of $313 million. The most notable adjustment to shareholder value was the removal of $624 million related to the fair value of total debt. This adjustment represents 20% of Allegiant’s market cap.

Attractive Funds That Hold ALGT

The following funds receive our Attractive-or-better rating and allocate significantly to Allegiant.

- US Global Jets ETF (JETS)– 4.6% allocation and Very Attractive rating

- Calvert Impact Small Cap Fund (CSCYX) – 3.3% allocation and Attractive rating

- Fidelity Select Air Transportation Portfolio (FSAIX) –3.2% allocation and Attractive rating.

Disclosure: David Trainer and Blaine Skaggs receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit:InSapphoWeTrust (Flickr)