Get more of our research from your Portfolio page(s).

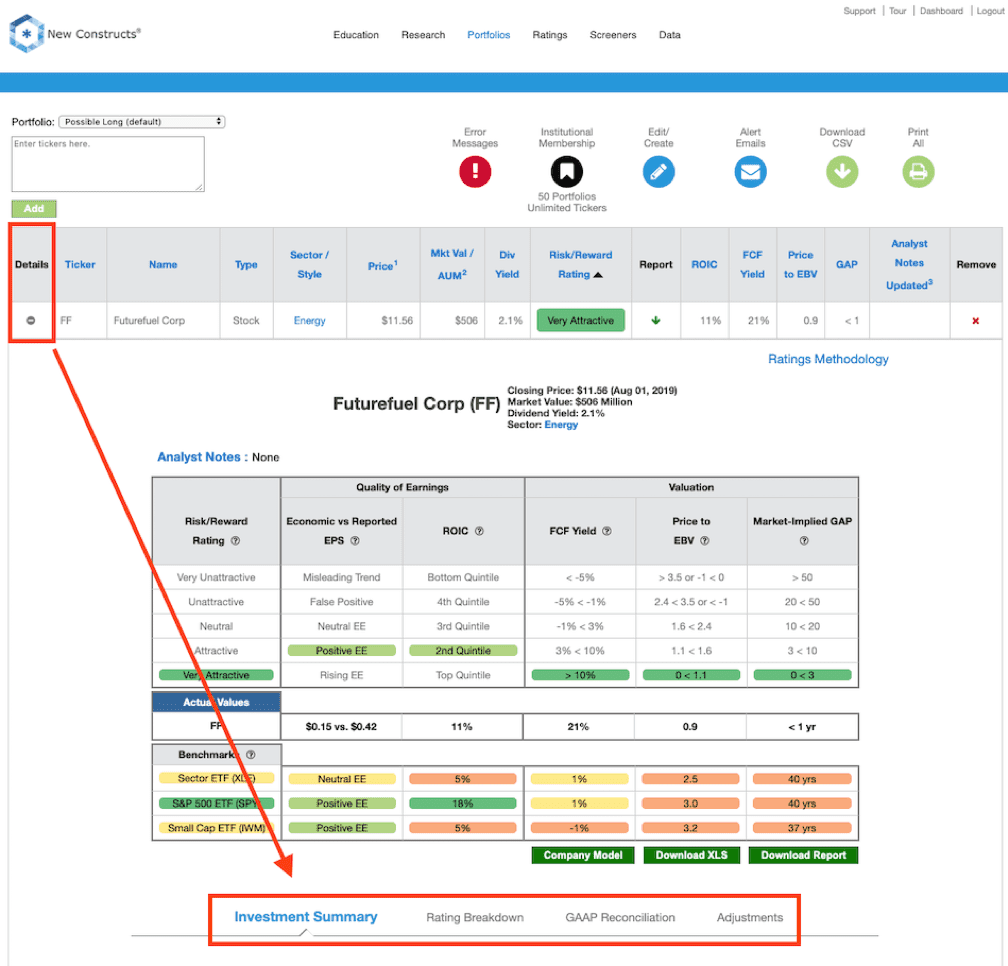

Per the picture below, click the “+” in the Details column next to any ticker and get Rating Breakdown, GAAP Reconciliation, and Adjustments details.

Most of this information was previously only available in the Institutional version of our PDF reports.

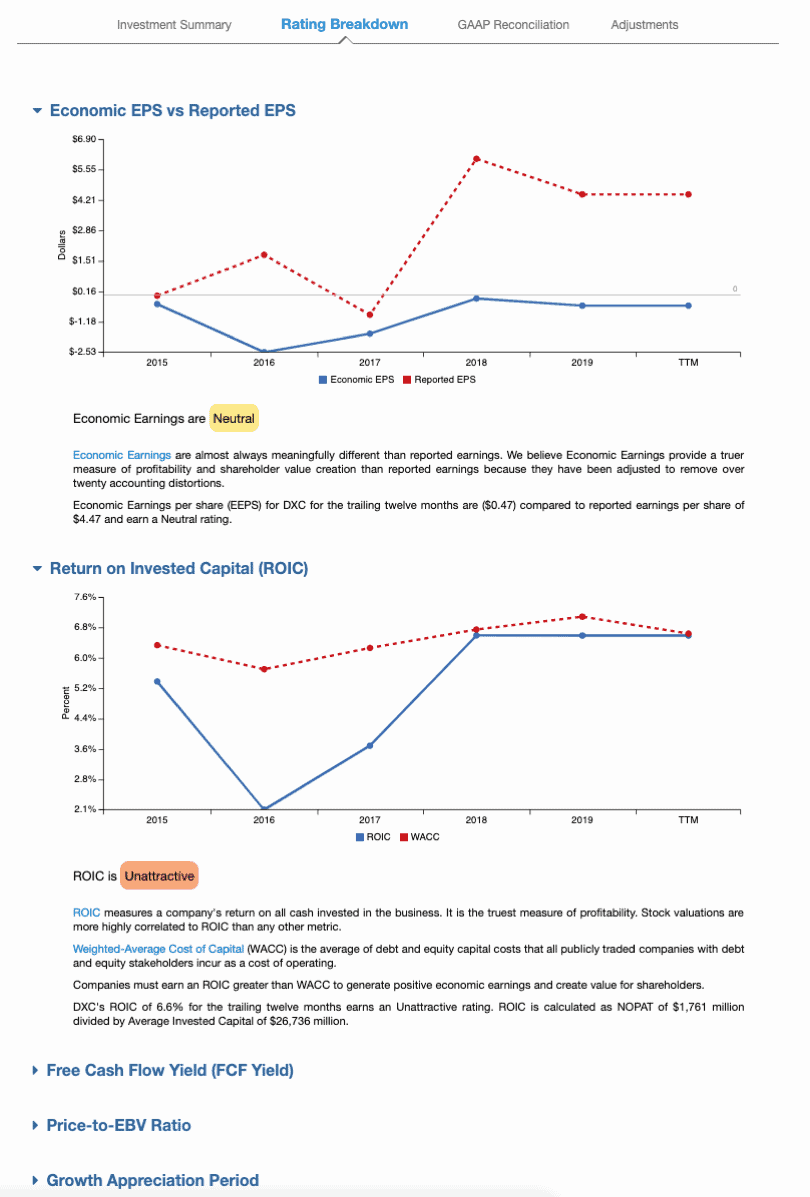

Rating Breakdown Tab

Get charts and more details on the key metrics that drive our overall Risk/Reward rating: economic vs. reported EPS, return on invested capital (ROIC), free cash flow (FCF) yield, price-to-economic book value (PEBV) ratio, and growth appreciation period (GAP). Expanding each of these sections will display up to five years of history for the selected metric.

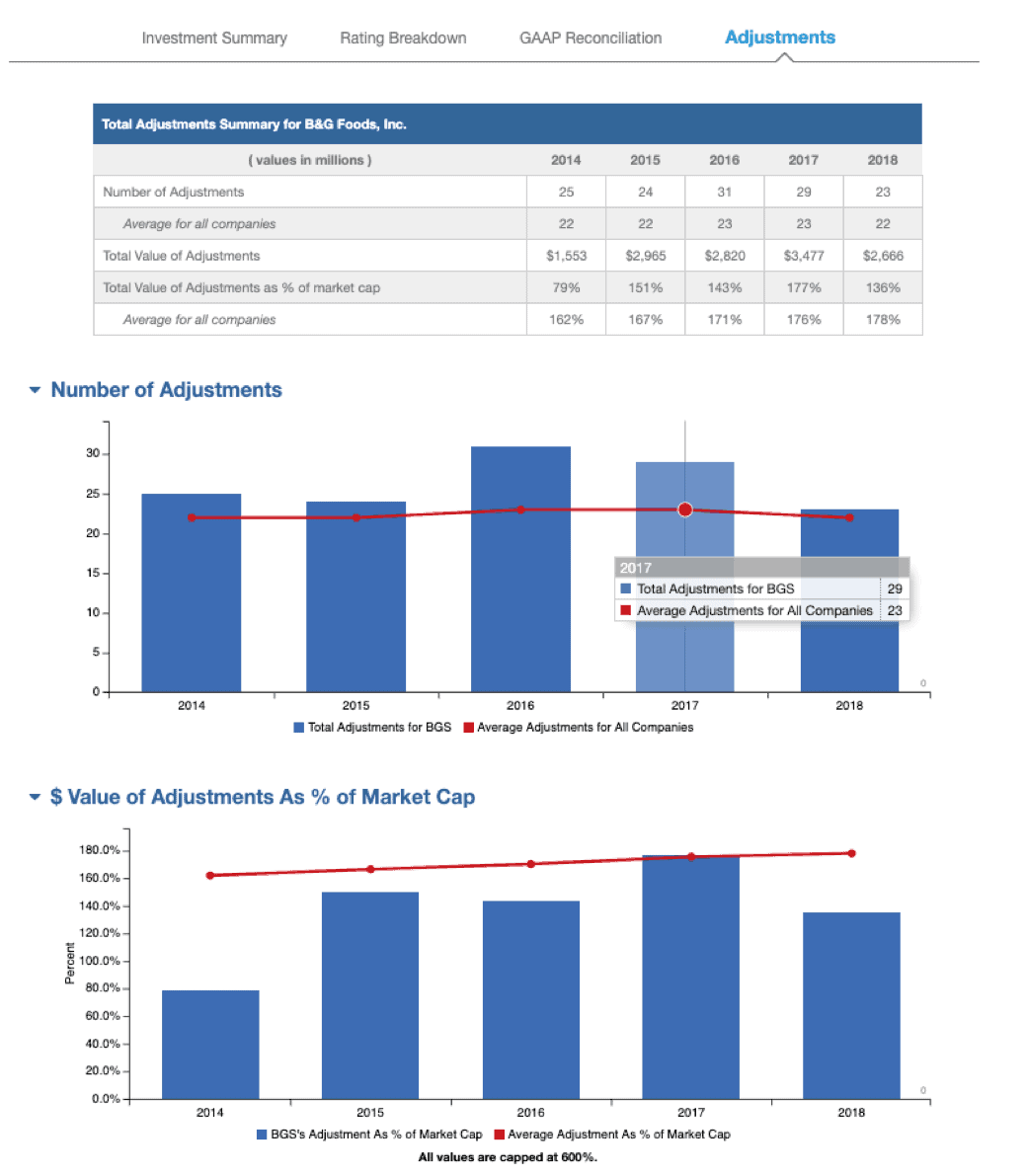

Adjustments Tab

Get a five-year history of the adjustments we make from key details found in the footnotes and MD&A of financial filings for each stock in your portfolio. See the number of adjustments, total dollar value of adjustments and as a percent of market cap and more, per image below.

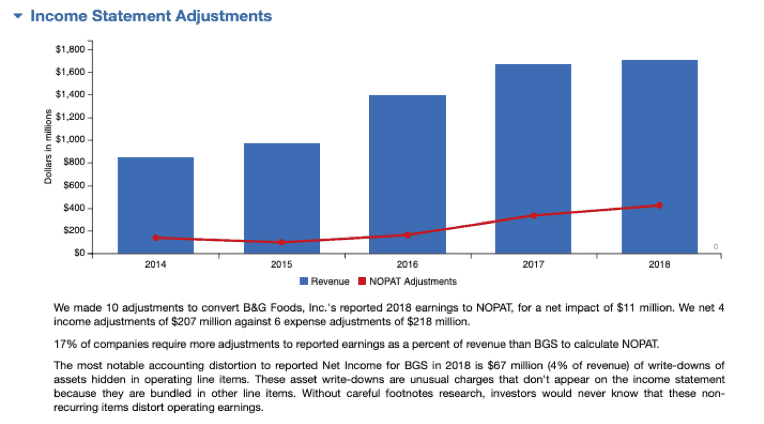

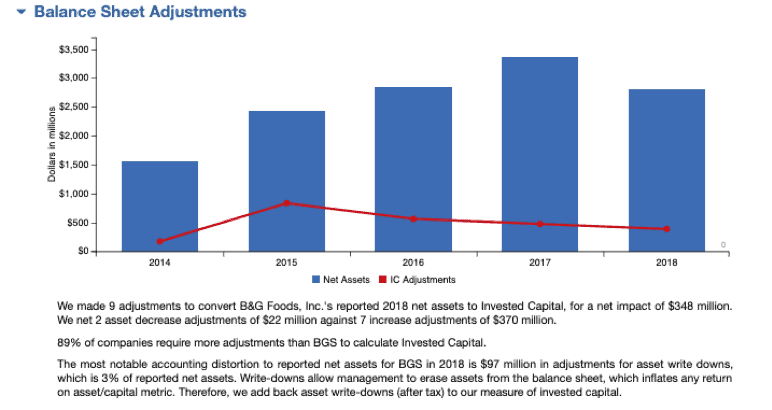

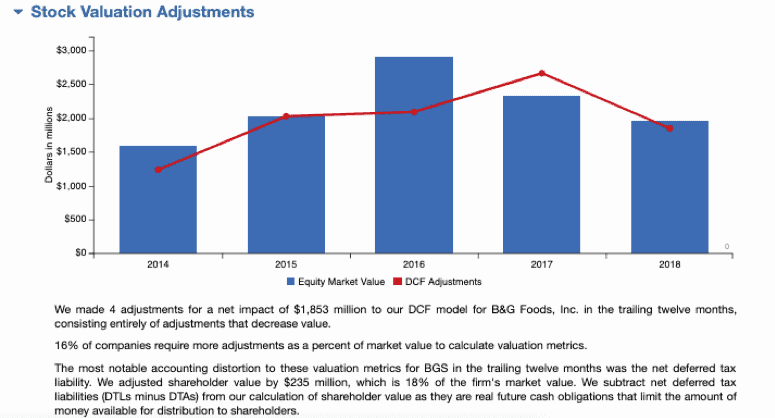

Get detailed breakdowns of the income statement adjustments, balance sheet adjustments, and stock valuation adjustments. Expanding each of these sections will provide up to five years of history as well as key details such as the number and size of the most notable adjustments for NOPAT, invested capital, and valuation. See image below.

GAAP Reconciliation Tab

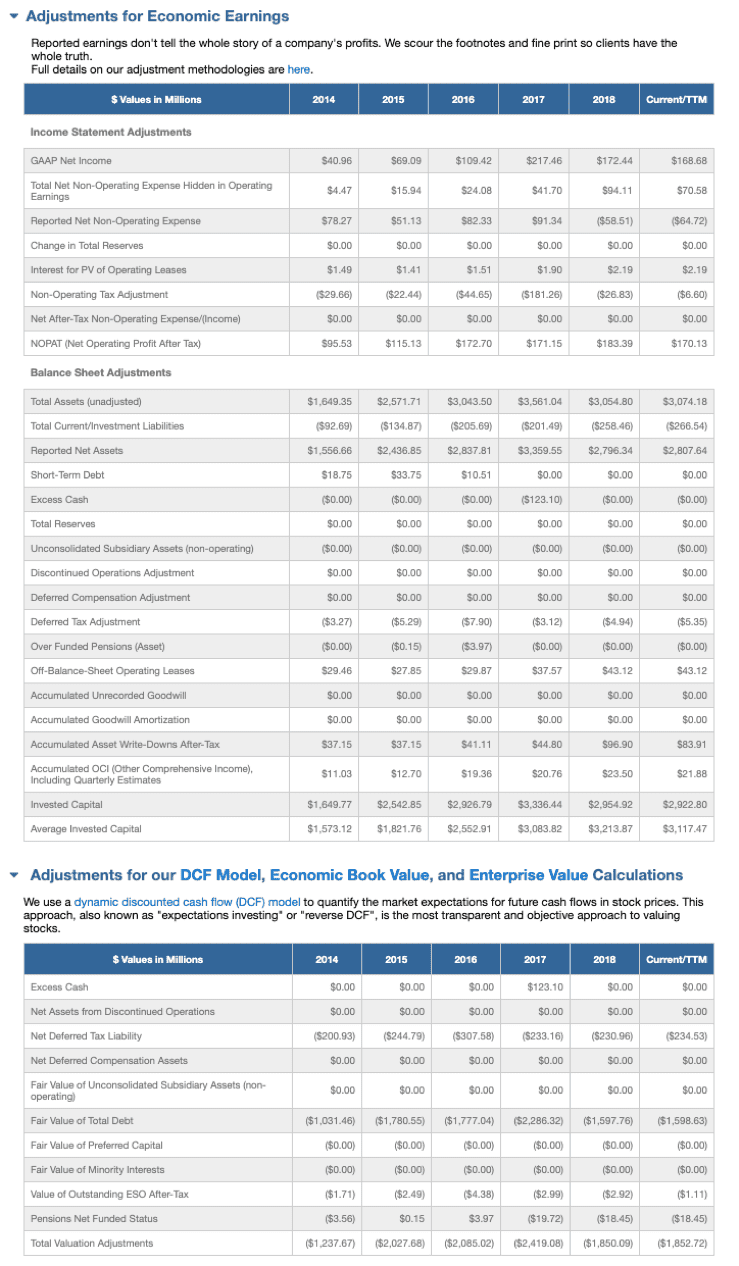

Get a five-year history of the reconciliation of GAAP net income to net operating profit after-tax (NOPAT) and reported total assets to invested capital along with all adjustments to our discounted cash flow (DCF) model.

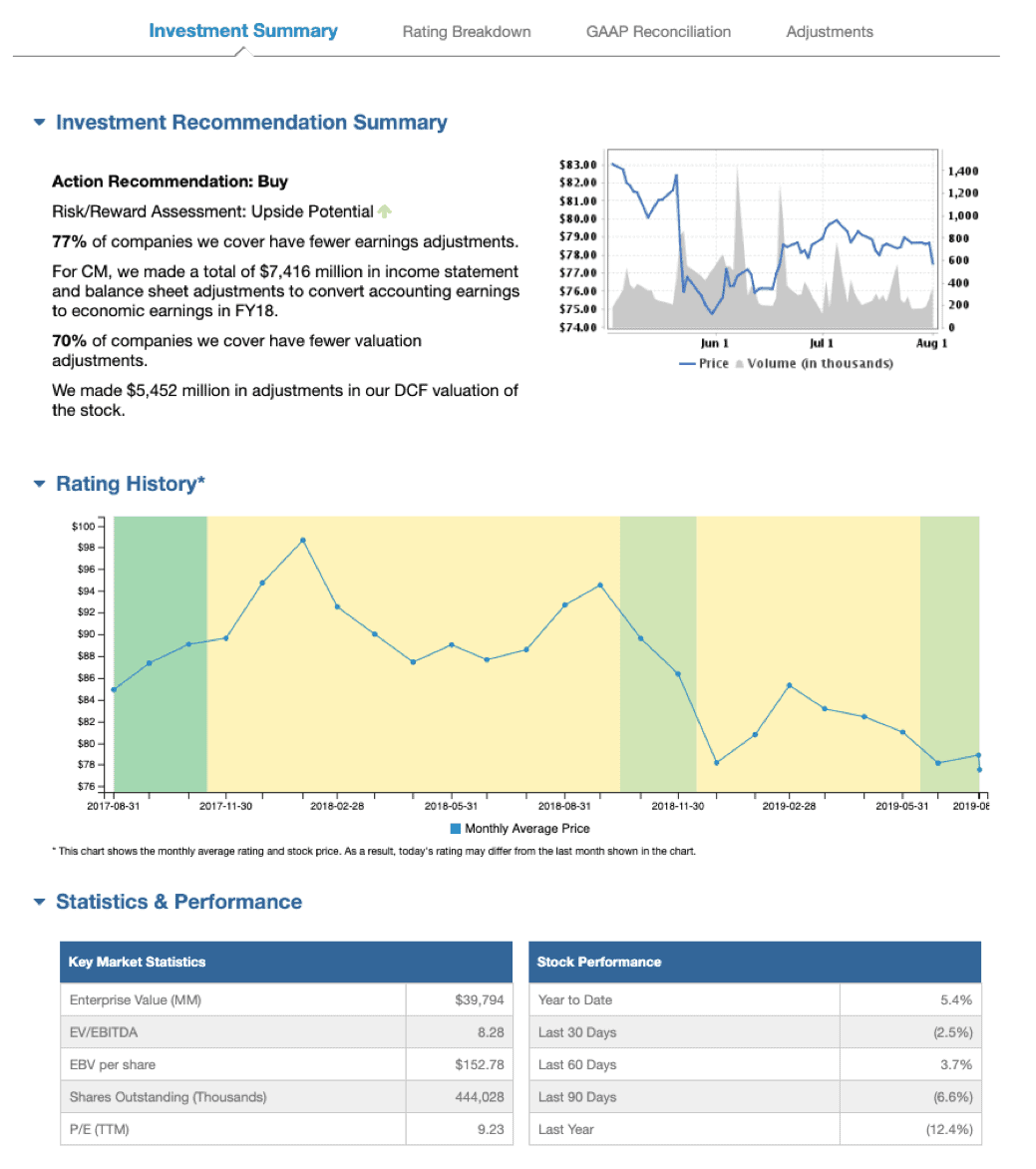

Investment Summary Tab

Our Investment Recommendation Summary, our Risk/Reward rating history, and market statistics, such as P/E, shares outstanding, and stock performance over different timeframes were already available.

Unlimited and Institutional members can also access this information directly on the Screeners and Ratings pages.

Please contact us at support@newconstructs.com if you have any questions.

This article originally published on September 4, 2019.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.