Expedia Group (EXPE: $130/share) – Closing Short Position – up 12% vs. S&P up 50%

Expedia Group (EXPE) was originally selected as a Danger Zone Idea on 9/14/15. At the time of the initial report, the stock received a Very Unattractive rating. Our short thesis noted value-destroying acquisitions, strong competition, and an overvalued stock price.

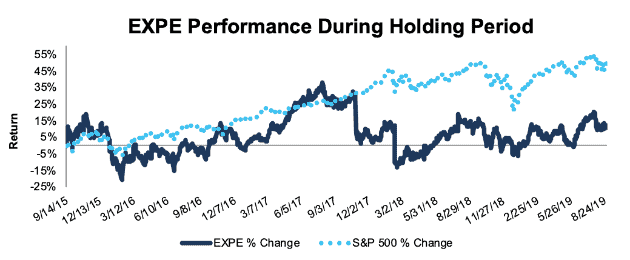

During the nearly 4-year holding period, EXPE outperformed as a short position, rising 12% compared to a 50% gain for the S&P 500.

In our original article, we noted that Expedia’s acquisitions, while accretive to reported earnings, were actually destroying shareholder value. However, the company has not made any major acquisitions since we wrote our article, and its return on invested capital (ROIC) is up from 4% in 2016 to 6% TTM.

In addition, Expedia has undergone significant changes in leadership. Former CEO Dara Khosrowshahi left to take over Uber, and the company recently completed the “acquisition” of Liberty Expedia (a holding company with super voting shares of Expedia) that helped clean up its governance structure.

EXPE no longer presents the same risk/reward given the improvement to corporate governance and rising ROIC. We are closing this short position.

Figure 1: EXPE vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on September 4, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.