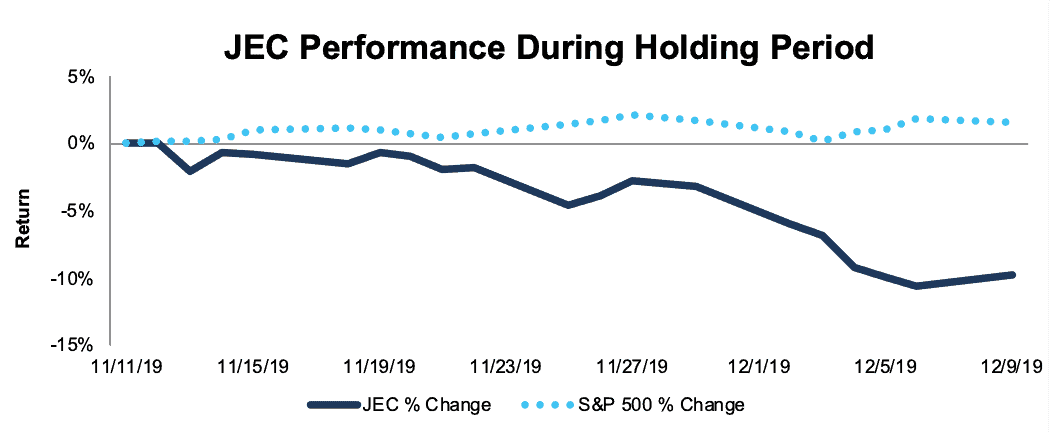

Jacobs Engineering Group (JEC) – Closing Short Position – down 10% vs. S&P up 2%

We put Jacobs Engineering Group (JEC: $86/share) in the Danger Zone on 11/11/19. At the time, JEC received a Very Unattractive rating and had among the most overstated earnings on our Earnings Distortion Scorecard.

Now that our technology is making Earnings Distortion free and easy for everyone to see, analysts would be remiss for not factoring better earnings research[1] into their models. What analyst wants to base their estimates off incomplete, and biased (as proven by this Harvard Business School & MIT Sloan paper), earnings?

Despite beating expectations in its 4Q19 earnings release, it’s clear that skepticism over the quality of Jacobs Engineering Group’s earnings weighs on the stock as analysts recently revised their EPS estimates down for both 2020 and 2021.

During the 29 day holding period, JEC outperformed as a short position, falling 10% compared to a 2% gain for the S&P 500.

This lower valuation means the risk in this stock has decreased and it now earns a Neutral rating. We believe it is time to take these gains and close this short position.

Figure 1: JEC vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on December 10, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] …Core Earnings [calculated using New Constructs’ novel dataset] is a superior accounting measure of a company’s operating earnings, and incremental to other measures when predicting future performance. – Core Earnings: New Data and Evidence – pg. 25