The Small Cap Growth style ranks tenth out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 11 ETFs and 455 mutual funds in the Small Cap Growth style as of April 23, 2014. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. Not all Small Cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 1705), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Small Cap Growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any Small Cap Growth ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Get my ratings on all ETFs and mutual funds in this style by searching for Small Cap Growth on my mutual fund and ETF screener. For more products, click here.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Vanguard S&P Small-Cap 600 Growth ETF (VIOG) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

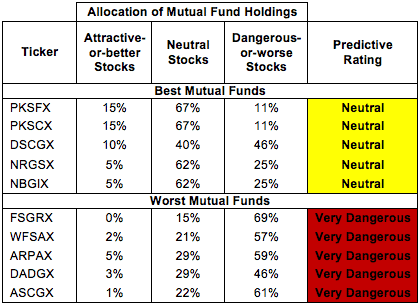

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Oak Associates Funds: River Oak Discovery Fund (RIVSX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

iShares S&P Small-Cap 600 Growth ETF (IJT) is my top-rated Small Cap Growth ETF and Virtus Equity Trust: Virtus Small-Cap Core Fund (PKSFX) is my top-rated Small Cap Growth mutual fund. IJT earns my Dangerous rating and PFSFX earns my Neutral rating.

ProShares Ultra Russell 2000 Growth (UKK) is my worst-rated Small Cap Growth ETF and Forum Funds: Adams Harkness Small Cap Growth Fund (ASCGX) is my worst-rated Small Cap Growth mutual fund. UKK earns my Dangerous rating and ASCGX earns my Very Dangerous rating.

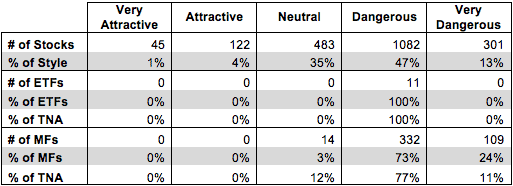

Figure 3 shows that 167 out of the 2033 stocks (over 5% of the market value) in Small Cap Growth ETFs and mutual funds get an Attractive-or-better rating. However, 0 out of 11 Small Cap Growth ETFs and 0 out of 455 Small Cap Growth mutual funds get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Small Cap Growth ETFs hold poor quality stocks.

Figure 3: Small Cap Growth Style Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

As detailed in “Low-Cost Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Small Cap Growth ETFs and mutual funds, no ETFs or mutual funds in the Small Cap Growth style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Investors should look at individual stocks for exposure to this investment style.

Assurant Inc. (AIZ) is one of my favorite stocks held by Small Cap Growth ETFs and mutual funds and earns my Very Attractive rating. Over the past nine years, AIZ has grown after tax profits (NOPAT) by 5% compounded annually. The company currently earns an 11% return on invested capital (ROIC) and has generated positive economic earnings every year since going public. Despite the consistent growth and impressive profitability, AIZ is priced for significant profit decline. At its current valuation of ~$67/share, AIZ has a price to economic book value (PEBV) ratio of 0.8. This ratio implies that the market expects AIZ’s NOPAT to permanently decline by 20%. This expectation is awfully pessimistic. Investors should look at AIZ before the market realizes the true value of the company.

Wabash National Corp (WNC) is one of my least favorite stocks held by Small Cap Growth ETFs and mutual funds and earns my Dangerous rating. Over the past eight years, WNC’s NOPAT has declined by 2% compounded annually. Over the same time, the company’s ROIC has fallen to 7%, down from 16% in 2005. Despite its declining NOPAT and profitability, WNC is priced for significant growth. To justify its current valuation of ~$14/share, WNC would need to grow NOPAT by 12% compounded annually for the next 38 years. Should investors really believe a company that hasn’t grown in close to a decade will be able to grow at double-digit rates for close to the next four decades? I don’t believe so. Investors should avoid WNC

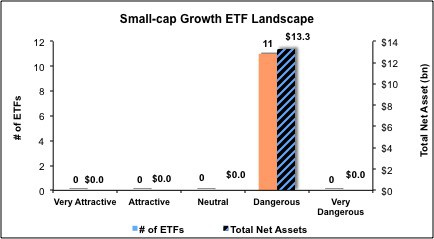

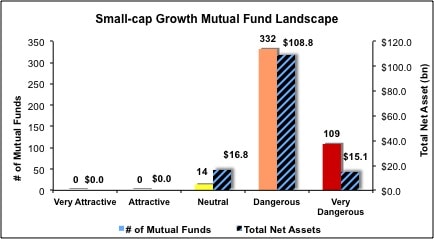

Figures 4 and 5 show the rating landscape of all Small Cap Growth ETFs and mutual funds.

My Style Rankings for ETFs and Mutual Funds report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with reports on all 11 ETFs and 455 mutual funds in the Small Cap Growth style.

To protect your portfolio from the worst ETFs and mutual funds, click here for a free trial.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style or theme.