Most investors are not aware that legacy metrics like Street Earnings (from Refinitiv) and Operating Earnings (from S&P Global (SPGI)) miss about $0.45 out of every $1.00 of unusual gains/losses (hidden and reported) – as detailed in section 5.1 of the new paper from HBS & MIT Sloan: Core Earnings: New Data & Evidence.

The purpose of measuring core earnings is to assess the normalized operating profitability of a business. Accordingly, analysts should strip out any gains/losses that are non-core, non-operating, or unusual when calculating core earnings[1]. We call the net sum of these unusual items Earnings Distortion.

We divide the unusual gains/losses that we strip out of core earnings, i.e. Earnings Distortion, into two major categories:

- “Reported” unusual gains/losses are disclosed on the income statement.

- “Hidden” unusual gains/losses are disclosed only in the footnotes or MD&A. One cannot find them on the income statement because they are bundled inside of another item reported on the income statement such as SG&A or Cost of Goods Sold.

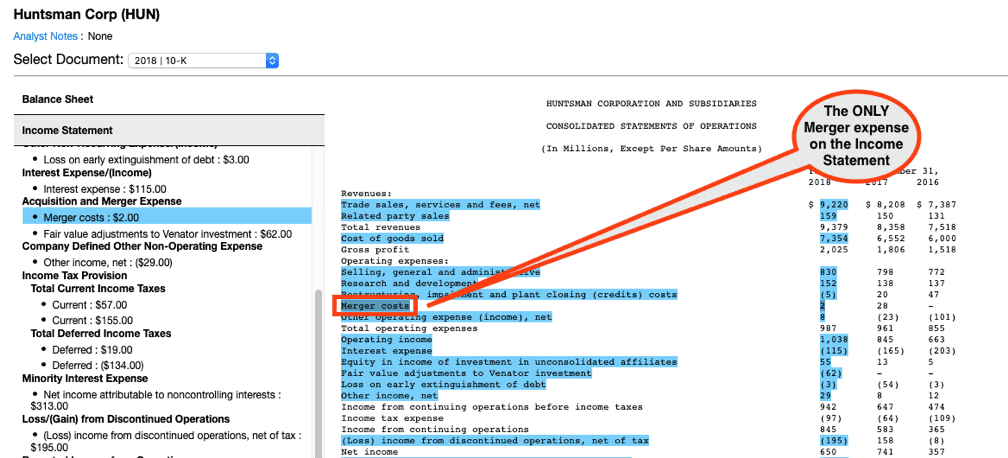

For an example of a “reported” unusual item, see the $2 million of Merger Costs on the income statement in the Huntsman Corp (HUN) 2018 10-K in Figure 1.

Figure 1: Huntsman Corp (HUN) Merger Costs Reported on the Income Statement

Sources: New Constructs, LLC and company filings

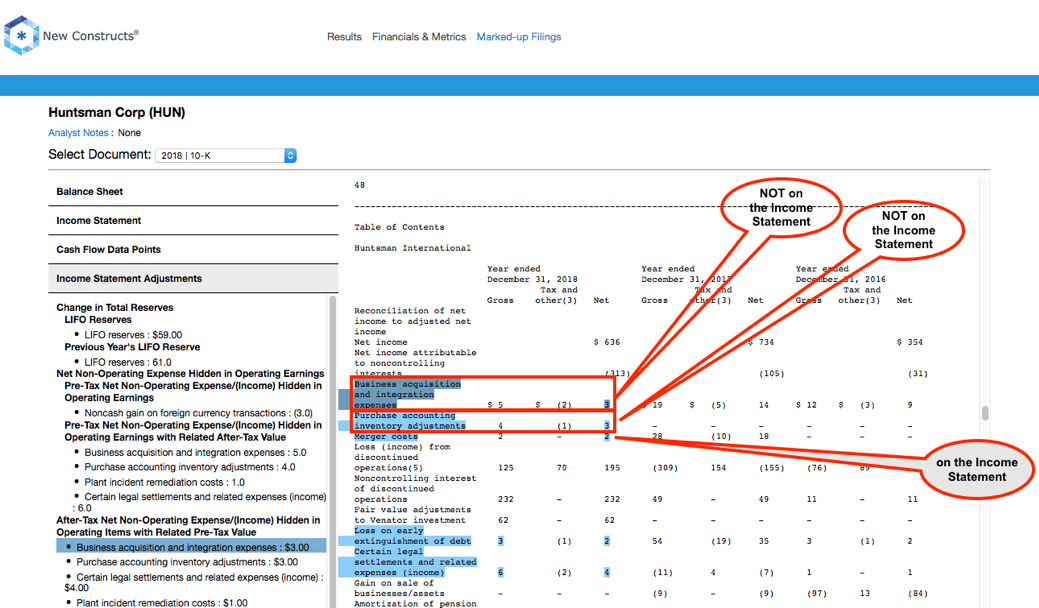

For an example of “hidden” unusual items, see the additional merger-related costs in the footnotes (page F-49) of the 2018 10-K in Figure 2.

- $3 million of “Business acquisition and integration expenses” and

- $3 million of “Purchase accounting inventory adjustments

Figure 2: Huntsman Corp (HUN) Merger Costs Hidden in the Footnotes

Sources: New Constructs, LLC and company filings

If an item appears on both the income statement and the footnotes, as does the $2 million of “Merger Costs" in Figures 1 and 2, we consider it "reported". Hidden items are truly hidden and available only from footnotes or MD&A research.

Most of the time line items called “Other” on the income statement bundle both usual and unusual items. If we find an unusual item bundled in the footnote breakout of “Other”, we classify it as “reported.”

The pictures in Figures 1 and 2 come from the Marked-Up filings section of our Company Models, which shows clients exactly where every data point used in our models appears in the original financial filings.

For more information on our calculation of core earnings, including details on all the hidden and reported items we collect, click here.

This article originally published on January 7, 2020.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In Core Earnings: New Data & Evidence, professors from Harvard Business School (HBS) & MIT Sloan show that stripping out unusual items has become increasingly difficult. So difficult, in fact, that most analysts are not doing it, and, as a result, markets inefficiently measure core earnings. The professors also show that our “novel dataset” of footnotes disclosures enables analysts to strip out the unusual items that distort core earnings measures from traditional sources, such as CompuStat and the street.