In our original report on Lyft (LYFT: $20-25 billion expected valuation), we warned against buying this expensive IPO because the company had no clear path to profitability and poor corporate governance.

Since then, potential investors have noted the company is “punting” questions on profitability, and a group of investors called on Lyft to abandon its dual-class share structure. Meanwhile, Lyft and Uber drivers are striking in Los Angeles, which raises more questions about the viability of the rideshare model.

With all these concerns, you’d expect investors to balk at Lyft’s lofty valuation. Instead, the IPO is reportedly oversubscribed and will price even higher than the initial range. Despite all the red flags, the rise of passive investing forces too many institutions to unconditionally buy a big IPO like Lyft, while big underwriting fees make Wall Street all too happy to give investors the hard sell.

Unconditional Passive Buying Boosts Demand

Attributing the demand for Lyft’s IPO to the rise of passive investing might confuse some readers. After all, passive funds won’t be buying in the IPO, and most major indexes won’t include the stock until years later. However, the passive mindset still plays a big role in its demand.

Research shows that ~60% of institutional investors are “quasi-indexers” that claim to be active, but in practice hold broadly diversified and undifferentiated portfolios. These institutional investors are trying to “hold the market” despite the fact that they don’t formally track an index.

When a major IPO like Lyft comes along with a market cap over $20 billion, it instantly becomes a significant portion of the market. For funds that focus on IPOs or tech stocks specifically [e.g. the Renaissance IPO ETF (IPO)], Lyft will be an even greater portion of their benchmark. These buyers don’t question Lyft’s business model or its corporate governance, they unconditionally buy simply to gain exposure to a high-profile name. If they don’t buy and the stock doubles, what are they going to tell investors?

Ironically, the more overvalued LYFT is, the more unconditional buyers there are. As a lower-profile stock, e.g. a $1 billion valuation, fewer investors would feel compelled to own the name, and there would likely be more attention to the heavy losses and dual-class shares. At $25 billion, more investors feel like they have to hold their nose and buy the stock no matter what.

Wall Street Knows How to Sell IPOs

As big institutions feel pressure to buy into Lyft’s IPO, Wall Street is more than happy to talk them into taking the plunge. It’s no surprise that Lyft lists 20 different banks as underwriters on its IPO. The more banks get a cut of its fees, the more Wall Street research departments have an (unwritten) incentive to issue “buy” ratings.

The incentives don’t end at the IPO either. Wall Street loves money-losing companies like Lyft, because those companies inevitably have to raise capital again in the future, which means more underwriting opportunities and more fees.

A successful IPO for Lyft could mean more fees from forthcoming IPOs. In other words, the more demand underwriters drive for this deal, the better their position to get a cut of upcoming IPOs like Uber, Pinterest, Airbnb, and others.

Wall Street knows how to sell, and with an audience that feels pressured to buy, it’s an easy job.

Poor Corporate Governance Is Now the Norm

Wall Street’s ability to sell stock aside, potential investors are correct to question Lyft’s dual-class share structure. The company’s founders will receive Class B shares that have 20x the voting rights of the Class A shares sold to the public. We showed how the dual-class structure created dysfunction and led to Snap Inc. (SNAP) falling far below its IPO valuation.

After the IPO, Lyft’s founders will own less than 5% of the stock but control 49% of the voting rights in the company, which means it would take a nearly unanimous vote from remaining shareholders to override the founders. In practice, it will be almost impossible for the average shareholder to have a meaningful say on corporate governance.

Dual-class shares have now become the norm, and it’s hard to find a recent IPO that actually gives public investors equal voting rights. Institutional investors have criticized this new norm and called on regulators, indexes, and stock exchanges to ban dual class shares.

Rather than asking someone else to solve the problem, institutions should address this problem directly and not buy the stock. Instead, they buy anyway and tacitly acknowledge that they are forced to have exposure to high-profile names no matter how bad the underlying merits of the offering.

Valuation Assumes the Best Case Scenario

As noted above, Lyft’s plans for profitability are murky at best. Even if we do believe they’ll eventually become profitable, though, it’s hard to believe in a scenario where the company can justify the future profit expectations baked into its valuation.

- High Competition Scenario: Lyft is barely able to scrape out an economic profit as any price increases further lower barriers to entry for new competitors. So, we assume the company earns the same margins as airlines prior to industry consolidation. If Lyft raises its pre-tax margins from -44.2% currently to 4% by the end of this fiscal year and grows revenue by 25% compounded annually for 10 years (~$20 billion in year 10), it has a fair value of $1.6 billion today, over 90% downside from the proposed valuation. See the math behind this dynamic DCF scenario.

- Duopoly Scenario: Lyft and Uber are able to control the U.S. market and keep out competitors, perhaps through some form of regulatory capture. This control of the market allows them to set prices at a profitable level, although they still face constraints, as regulated firms, as to how high they can go. If we use the same revenue growth scenario and double pre-tax margins to 8% (more comparable to airlines after consolidation), Lyft has a fair value of $8.5 billion today, about 62% downside from the proposed valuation. See the math behind this dynamic DCF scenario.

- Self-Driving Scenario (best case): What would Lyft be worth to GM or another company that develops self-driving technology? In this scenario, we optimistically assume, for arguments sake, Lyft captures a significant amount of the value from self-driving technology. If we keep the same revenue growth and double Lyft’s margins again to 16% (closer to an online platform like EBAY), then the firm is worth $23 billion. See the math behind this dynamic DCF scenario.

To say Lyft is priced for the best-case scenario is an understatement. A $23 billion valuation assumes the company either magically becomes highly profitable while maintaining its growth rate for a long period of time, or convinces someone to buy it for far more than it would cost to replicate what they’ve done.

Instead of balking at this high valuation, investors are bidding it up even higher. The company recently announced that it’s raising the price range on its IPO from $62-$68/share up to $70-$72/share. At the high end of the new price range, Lyft would be worth ~$25 billion, accounting for all employee stock options and restricted share units.

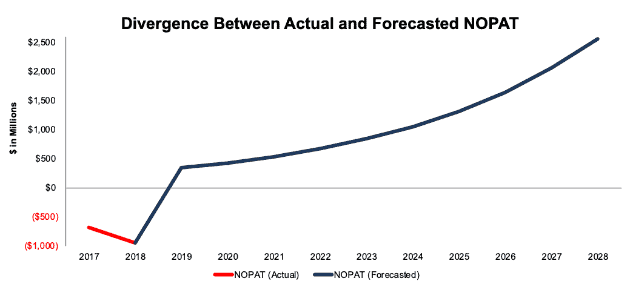

Figure 1 shows just how optimistic the profit growth in the self-driving scenario is compared to Lyft’s present cash flows.

Figure 1: Lyft’s Present NOPAT vs. Future NOPAT Required to Justify Valuation

Sources: New Constructs, LLC and company filings

Money Losing IPOs Have a Bad Track Record

If history is any indicator, the hype around the Lyft IPO will end poorly for investors. According to the Wall Street Journal, Lyft has lost more money than any IPO in history. As Figure 2 shows, the top 5 IPOs in reported losses prior to Lyft have all disappointed.

Figure 2: Five Biggest Money-Losing IPOs Before Lyft

Sources: Wall Street Journal

Many of these companies enjoyed big pops on their first day and for a while thereafter. SNAP’s IPO was also oversubscribed. However, eventually and inevitably, the market recognized that these firms’ fundamentals couldn’t justify their valuations.

No matter how much passive investors and sell-side analysts juice demand in the short-term, the fundamentals will win out in the end.

This article originally published on March 27, 2019.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Daniel X. O'Neil (Flickr)