Our Stock Pick of the Week Is…

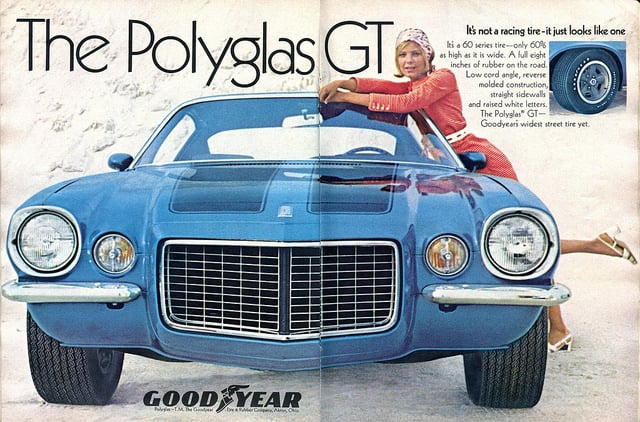

The best stock picks in today’s market are becoming increasingly rare: large, high-quality companies with great growth potential that are also cheap. However, as we’ve started to incorporate this year’s batch of annual reports into our models, we’ve managed to find one such stock. This company makes products that will likely never become obsolete as long as people need to get around or move things. We tend to like companies that produce staple goods like this, as they offer limited downside. The upside? This company’s increased operating efficiency and bargain bin price. This week’s stock pick of the week is the 117-year old Goodyear Tire & Rubber Company (GT).

A Company That Needs No Introduction

Goodyear, founded in 1898, is one of America’s oldest companies and the third-largest tire manufacturer in the world. It began producing automobile tires but has since expanded to supply the aviation, agricultural, mining, and other industries. While 87% of Goodyear’s sales are new tires, the company also sells rubber and chemicals to other parties and businesses and provides automotive repair services.

So Why Buy Goodyear Now?

Goodyear is operating at its highest efficiency of any time in the past 16 years. In 2014, Goodyear earned an after-tax operating profit (NOPAT) of almost $1.4 billion, its highest ever in our model. Despite a 7% revenue decline, the company’s NOPAT was up over 11% year over year. Growing profits is nothing new either, as NOPAT has risen by 24% compounded annually since 2009. This is a direct result of cost of sales that declined 26% and SGA that declined 4% from 2011, bringing total expenses down by 21%.

Investors can see this expense reduction manifest itself in something tangible: Goodyear’s number of manufacturing plants. In 2006, the company had 96 plants worldwide. This has been reduced to only 50 in 2014.

All of this expense trimming has raised Goodyear’s after-tax margins to almost 8%, up from 4% in 2012, and its return on invested capital (ROIC) from under 6% in 2012 to 9% today.

Should You Be Worried About Rubber Prices?

Many sell-side analysts appear to be concerned about the impact of declining rubber prices on Goodyear’s bottom line. It’s true that the price of rubber has been on the decline since its spike in 2011, and this decline has almost certainly been accretive to Goodyear’s operating profit. However, much of Goodyear’s profit gain is still due to the company’s vastly increased operating efficiency, as Goodyear’s profit margins of 8% are over twice as high as they were in 2005, when the price of rubber was on par with today’s price.

As we noted earlier this week, commodity prices will not stand in the way of lean, well-run businesses over the long term. To that effect, Goodyear earned almost $1.7 billion in free cash flow in 2014, and $6.8 billion in cumulative free cash flow since current CEO Richard Kramer joined the company as vice president of corporate finance in 2000. Goodyear has proven its ability to generate cash no matter the price of its inputs.

Tire shipments also tend to track vehicle shipments, and with the recent rise in auto sales Goodyear is poised for another record year.

These Adjustments Reveal Goodyear’s Operating Profitability and Valuation

We make several key adjustments to the earnings and balance sheets of companies to uncover the recurring cash flows of each company’s core business and the value left for shareholders. We made the following major adjustments to Goodyear’s earnings in 2014:

- Removed $189 million in non-operating expenses hidden in operating earnings

- Removed $825 million reported non-operating expenses included in operating earnings

- Added back $2.2 billion in taxes due to non-operating expenses lowering operating earnings

When considering Goodyear’s valuation, we also add $1 billion in off-balance sheet debt (13% of total debt) due to operating leases to Goodyear’s reported debt, bringing the company’s total debt to $7.5 billion, or 102% of its market capitalization. We also subtract $817 million in minority interests and $1.1 billion from the company’s underfunded pension in our calculation to reach shareholder value.

Goodyear is a Steal at These Prices

Despite these extra cash obligations like pensions and off-balance sheet debt, Goodyear is cheap at its current price of $27/share. This price gives GT a price to economic book value (PEBV) ratio of just 0.8, which implies that the market expects Goodyear’s profits to permanently decline by 20%. This seems extremely pessimistic when considering Goodyear’s increased operational efficiency and the increased automobile sales in this country.

If Goodyear can grow NOPAT by just 2% compounded annually for the next 13 years, the company is worth $39/share — a 44% upside from current levels. It will be difficult for Goodyear to fail to beat expectations as low as these when considering the company’s historical profit growth rate of 18% compounded annually since 2000.

At current levels Goodyear has excellent upside and little downside. The company’s healthy free cash flow should assist it in paying off its significant debt and pension obligations, as should the fact that the company’s cash tax rate will be effectively 0% for the next five years due to a deferred tax allowance. GT is a steal at its current price.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photocredit: SenseiAlan