March Madness is nearing its end, but stock market madness is not letting up. Upsets might be exciting in basketball, but not so much in the stock market. No one wants a stock they own to blow up.

Our Danger Zone picks are specifically meant to help you avoid a portfolio upset. Only the worst of the worst stocks, ETFs and mutual funds get put in the Danger Zone.

Our proven-superior fundamental research gives us an edge in finding the worst and the best stocks. Diligence is the name of the game and can be the difference in feeling like you’re heaving up half court shots as the clock hits zero or methodically executing a strong game plan.

This week’s Danger Zone pick is especially dangerous. The company’s valuation, as measured by the growth in cash flows implied by its stock price, implies never seen before profit growth and a 5x increase in its market share.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

We originally put this company in the Danger Zone in October 2021 prior to its IPO. Since the company’s IPO, it has outperformed as a short by 79%, falling 53% while the S&P 500 is up 26%.

Despite the outperformance as a short, this stock remains dangerous. After analyzing the company’s fiscal year 2025 10-K, our short thesis still stands. The company is dwarfed by its competition, remains unprofitable, and its stock price is too expensive and offers much more downside risk than upside potential.

What’s Working

This company grew its total revenue 31% year-over-year (YoY) in fiscal 2025. Additionally, in fiscal 2025, the number of customers that generate:

- more than $5,000 of annual recurring revenue (ARR) increased 15% YoY.

- more than $100,000 of ARR increased 29% YoY.

- more than $1 million of ARR increased 28% YoY.

The company also beat on both the top- and bottom-line when it reported fiscal 4Q25 results.

What’s Not Working

Just focusing on top-line growth, rather than trends, would be short-sighted. For instance, the customer segments noted above all grew at lower YoY growth rates in fiscal 2025 than in fiscal 2024. Slowing top-line growth is just one of the concerns of investing in this company at current levels, as we’ll show below.

Conversion Rate Is Not Nearly High Enough

The freemium business model has been around for many years, and industry analysis estimates that most software-as-a-service (SaaS) companies have a 2%-5% freemium conversion rate. Conversion rate refers to the percentage of free users converted into paying users.

There’s no doubt the company has successfully attracted users. Its total registered users have increased from an estimated 30 million in fiscal 2024 to “more than 50 million” in fiscal 2025. Over the same time, the company’s base customers, which are the customers that generate more than $5,000 in ARR, increased from 8,602 to 9,893. In other words, in a time when the company’s reported estimate of registered users increased 20 million, its base customers increased by 1,291, much less than the average 2-5% conversion noted above.

The number of customers that generate higher ARR is also still a small portion of the company’s base customers. In fiscal 2025, the number of customers that generate more than $100,000 and more than $1 million in ARR were 1,229 and 123, respectively.

The company’s revenue is largely dependent on converting free users into paying users. The fact that the company converts so few continues to be alarming.

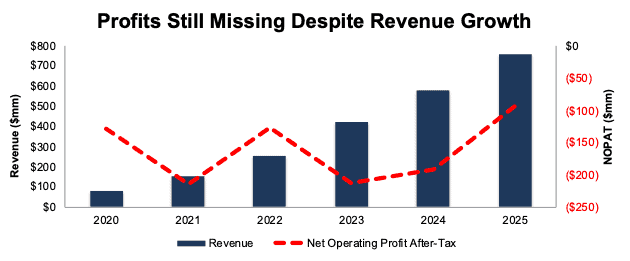

Figure 2: Revenue and NOPAT: Fiscal 2020 – 2025

Sources: New Constructs, LLC and company filings.

Existing User Upsells Are Slowing Too

As the company converts fewer free users to paid users, the recurring revenue generated by existing users is growing at slower rates in recent years.

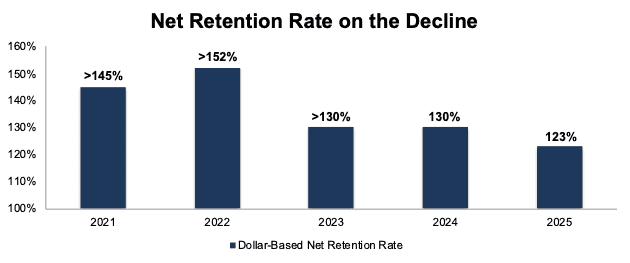

The company measures its ability to retain and expand revenue generated by its existing customers in the form of dollar-based net retention rate, which is calculated by the dividing the current period ARR by the previous period ARR derived from its customer base at a point in time.

The company’s dollar-based net retention rate fell from over 145% in fiscal 2021 to 123% in fiscal 2025. See Figure 3.

Figure 3: Dollar-Based Net Retention Rate: Fiscal 2021 – Fiscal 2025

Sources: New Constructs, LLC and company filings.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.