We’re taking six stocks off our Zombie Stocks list and closing three Danger Zone picks.

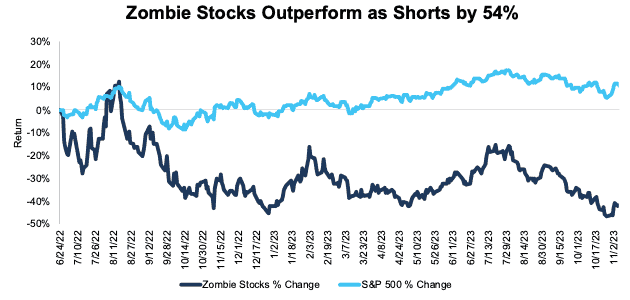

We started our Zombie Stock list in June 2022 and have added a total of 33 stocks to the list. Post this report, 24 stocks remain on the list. As rising rates drive up the cost of capital and force investors to become more discerning, many Zombie Stocks have fallen precipitously. So, we expect we’ll be removing more stocks in the coming weeks.

As a reminder, to make the Zombie Stock list, companies must:

- have less than 24 months of cash to sustain their high cash burn,

- have a negative interest coverage ratio (EBIT/Interest expense), and

- be a Danger Zone stock.

See this index and the end of this report for performance details on all of the Zombie Stocks.

Zombie Stock Picks to Close

See Figure 1 for the Zombie Stocks we are removing from the list and their performance vs. the S&P 500.

Figure 1: Closed Zombie Stocks: Performance as of Closing Prices on 11/6/23

| Company | Ticker | Publish Date | Return as Short vs. S&P 500 Since Named Zombie |

| Allbirds Inc. | BIRD | 10/17/22 | 89% |

| Oatly Group | OTLY | 11/21/22 | 72% |

| GameStop Corporation | GME | 8/15/22 | 69% |

| Chewy Inc. | CHWY | 8/17/22 | 57% |

| Ceridian HCM Holding Inc. | CDAY | 11/23/22 | 11% |

| Atlassian Corporation | TEAM | 11/16/22 | -32% |

Sources: New Constructs, LLC and company filings

Below, we provide details on why we’re closing each position.

Allbirds Inc. (BIRD)

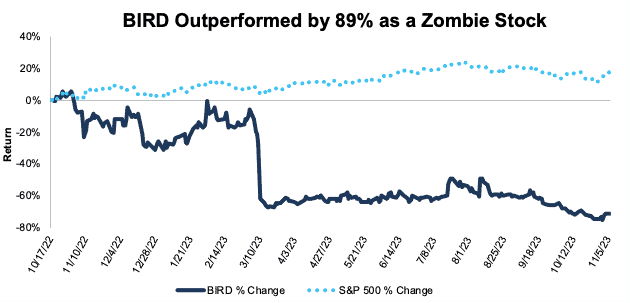

We first put Allbirds Inc. (BIRD: $0.93/share) in the Danger Zone on September 23, 2021, just before its IPO, and made it a Zombie Stock on October 17, 2022. Our short thesis highlighted the firm’s profitless revenue growth, increasing costs, weak competitive position, and overvalued IPO price.

Since our Danger Zone report, BIRD has outperformed as a short by 94%, falling 96% compared to a 2% decline in the S&P 500.

When we named Allbirds a Zombie Stock, its free cash flow (FCF) burn was increasing, and it had enough cash to sustain the burn for just 14 months. Since we added Allbirds to our Zombie Stock list, the stock has outperformed by 89% as a short, falling 72% compared to a 17% gain for the S&P 500.

Today, Allbirds has just eight months before it runs out of cash at its current cash burn rate, but with the stock now below $1, we’re taking it off the Zombie Stock List. We’re taking the 89% outperformance as a short as a win. Plus, stocks under $1 see very limited trading and even the slightest moves results in large percentage changes. Lastly, the lower valuation increases stupid money risk. As a result, we believe it’s time to close this successful Danger Zone and Zombie Stock pick.

Figure 2: BIRD vs. S&P 500 – Price Return as a Zombie Stock – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Oatly Group (OTLY)

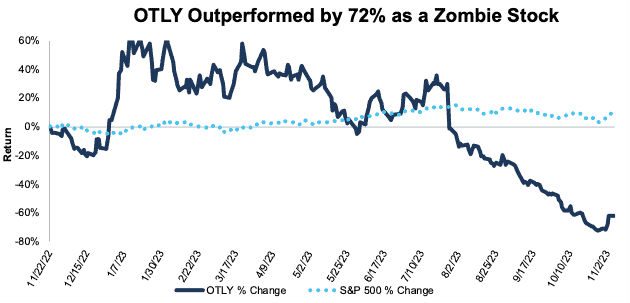

We put Oatly Group (OTLY: $0.49/share) in the Danger Zone and declared it a Zombie Stock on November 21, 2022. Our short thesis highlighted the firm’s rising expenses, its distributors increasingly becoming competitors, the company’s highly negative return on invested capital (ROIC), and overvalued stock price. Oatly could only sustain its (at that time) cash burn for one month unless it raised additional capital.

Since our Danger Zone report, OTLY outperformed the market as a short by 72%, falling 62% compared to a 9% gain for the S&P 500.

Oatly’s poor competitive position hasn’t changed, as the company earns a -24% ROIC while FCF remains negative. However, as with Allbirds above, Oatly’s stock has fallen below $1 and no longer provides the same risk/reward as when we named it a Zombie Stock. We believe it’s time to close this successful Danger Zone and Zombie Stock pick.

Figure 3: OTLY vs. S&P 500 – Price Return as a Zombie Stock – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

GameStop Corporation (GME)

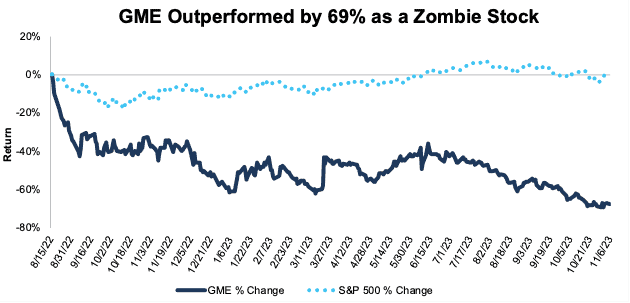

We named GameStop (GME: $14/share) a Zombie Stock on August 15, 2022. Our short thesis highlighted GameStop’s soaring meme-sock driven valuation, lack of profitability relative to peers, and increasing FCF burn.

Since our original Danger Zone report, in April 2021, GME has outperformed as a short by 78%, falling 71% compared to a 7% gain for the S&P 500. Since we added GameStop to our Zombie Stock list, the stock has outperformed as a short by 69%, falling 68% compared to a 1% gain in the S&P 500.

When we named GameStop a Zombie Stock, it could only sustain its FCF burn for 18 months.

Since then, however, the company raised over $1 billion through a share offering in June 2022. The offering more than doubled its cash on hand, which, along with positive FCF in the TTM period, greatly increases its cash-burn runway to over 69 months (based on 2-year average FCF burn). Accordingly, GameStop no longer qualifies as a Zombie Stock. Even though we are removing GameStop from the Zombie Stock list, it still remains in the Danger Zone

Figure 4: GME vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Chewy Inc. (CHWY)

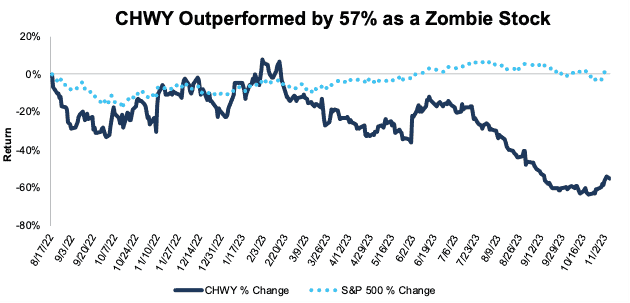

We made Chewy (CHWY: $21/share) a Zombie Stock on August 17, 2022. Our short thesis highlighted the firm’s poor profitability, its consistent cash burn, and overvalued stock price.

Since our original Danger Zone report in June 2019, CHWY outperformed as a short by 94%, falling 43% compared to a 51% gain for the S&P 500. Since we added Chewy to our Zombie Stock list, the stock outperformed as a short by 57%, falling 55%, compared to a 2% gain in the S&P 500.

When we added Chewy to our Zombie Stock list, the company could only sustain its cash burn for 24 months.

Since then, Chewy improved its ROIC has improved from -349% in 2020 to 7% over the TTM. With improving profitability, Chewy generated positive FCF for the first time in the company’s history in the TTM ended fiscal 2Q24. As a result, the company now has longer than 24 months of runway before it runs out of cash; so it no longer qualifies as a Zombie Stock.

Even though Chewy was able to stave off its recent liquidity crisis, we believe the improvements in fundamentals aren’t sustainable given the ample competition in the market. Additionally, its stock is still overvalued as the company has a price-to-book value (PEBV) ratio of 73, which means the market expects Chewy to improve its NOPAT by 73x TTM levels. Hence, Chewy remains in the Danger Zone despite being off the Zombie Stocks list.

Figure 5: CHWY vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Ceridian (CDAY)

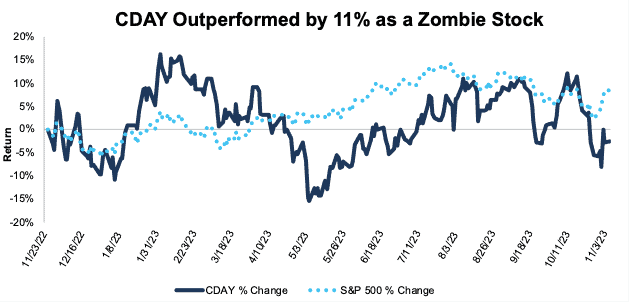

We named Ceridian (CDAY: $65/share) a Zombie Stock (and added it to the Danger Zone) on November 23, 2022. Our short thesis noted Ceridian’s declining NOPAT, ROIC, and economic earnings, large FCF burn, low profitability relative to competitors in the human capital management (HCM) market, and overvalued stock price. We named Ceridian a Zombie Stock because it could only sustain its (at the time) cash burn for nine months.

Since our original report, CDAY outperformed as a short by 11%, falling 3% compared to an 8% gain for the S&P 500.

Ceridian’s profitability, including ROIC and NOPAT margin, improved in 2022 and the TTM period. Ceridian also reversed years of cash burn and generated positive FCF in both 2022 and the TTM period. The increase in profitability and improvement in FCF means Ceridian no longer qualifies as a Zombie tock.

Although Ceridian’s fundamentals have improved, its stock remains too expensive. We are removing Ceridian from the Zombie Stock list, but it remains in the Danger Zone.

Figure 6: CDAY vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Atlassian Corp. (TEAM)

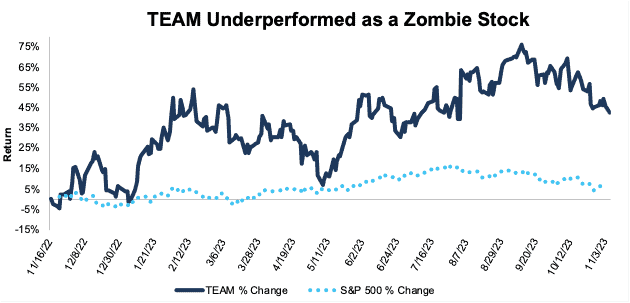

We put Atlassian Corp (TEAM: $175/share) in the Danger Zone and named it a Zombie Stock on November 16, 2022. Our short thesis highlighted Atlassian’s deteriorating NOPAT and economic earnings, accelerating cash burn, low profitability relative to competitors, slowing customer acquisitions, and overvalued stock price. We named Atlassian a Zombie Stock because it could only sustain its (at that time) cash burn for 23 months.

Since our original report, TEAM underperformed as a short position by 32%, rising 43% compared to an 11% gain for the S&P 500.

Atlassian’s fundamentals remain bad, as the company earns a -83% ROIC and a -7% NOPAT margin over the TTM period. However, the company slowed its cash burn from -$706 million in fiscal 2023 to -$205 million in fiscal 2023 while also increasing its cash on hand to sustain the cash flow burn. As a result, Atlassian has more than 24 months of runway before it runs out of cash based on its current FCF burn rate, and no longer qualifies as a Zombie Stock.

Even though the stock remains expensive, Atlassian can sustain its cash burn for over 68 months based on its 2-year average FCF burn. Furthermore, as a software-as-a-service business, investors may be willing to overlook cash burn and prop the stock up on hopes of getting acquired for the foreseeable future. As a result, we are taking this stock off both the Danger Zone and Zombie Stock lists.

Figure 7: TEAM vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

The Full Zombie Stock List

24 stocks remain on the Zombie Stock list. These stocks have a real risk of going to $0/share, especially as markets adjust to a “higher for longer” interest rate environment that will challenge many of these companies.

Figure 8 shows all 33 Zombie Stocks. We mark those that have been removed from the list with an asterisk. For real-time tracking of this Model Portfolio, see the index Thematic created for it.

Figure 8: Zombie Stock Reports: Performance Since Publish Date Through 11/6/23

| Company Name | Ticker | Date Added | Return Since Add Date | Return as Short Vs. S&P 500 |

| Freshpet Inc.* | FRPT | 6/23/22 | -16% | 9% |

| Peloton Interactive | PTON | 6/23/22 | -54% | 66% |

| Carvana Co. | CVNA | 6/23/22 | 5% | 6% |

| Snap Inc. | SNAP | 7/22/22 | 8% | 2% |

| Beyond Meat, Inc. | BYND | 8/1/22 | -60% | 67% |

| Rivian Automotive | RIVN | 8/8/22 | -53% | 59% |

| DoorDash, Inc. | DASH | 8/10/22 | 14% | -11% |

| Shake Shack, Inc. | SHAK | 8/10/22 | 10% | -6% |

| AMC Entertainment | AMC | 8/15/22 | -95% | 97% |

| GameStop Corporation* | GME | 8/15/22 | -68% | 69% |

| Chewy Inc.* | CHWY | 8/17/22 | -55% | 57% |

| Uber Technologies | UBER | 8/17/22 | 60% | -58% |

| Robinhood Markets | HOOD | 8/22/22 | 4% | 1% |

| Tilray Brands | TLRY | 9/7/22 | -46% | 54% |

| Affirm | AFRM | 9/19/22 | -2% | 15% |

| Sunrun | RUN | 9/21/22 | -67% | 85% |

| Blue Apron * | APRN | 9/26/22 | -79% | 95% |

| RingCentral | RNG | 10/3/22 | -34% | 49% |

| Allbirds Inc.* | BIRD | 10/17/22 | -71% | 89% |

| Wayfair | W | 11/14/22 | 10% | 0% |

| Atlassian* | TEAM | 11/16/22 | 43% | -32% |

| Bill.com | BILL | 11/16/22 | -48% | 58% |

| Okta | OKTA | 11/16/22 | 38% | -27% |

| Oatly* | OTLY | 11/21/22 | -62% | 71% |

| Twilio | TWLO | 11/23/22 | 10% | -1% |

| Ceridian* | CDAY | 11/23/22 | -3% | 11% |

| Redfin | RDFN | 11/30/22 | 5% | 3% |

| Five9 Inc. | FIVN | 12/5/22 | 0% | 11% |

| Opendoor | OPEN | 1/30/23 | -9% | 16% |

| Compass Inc. | COMP | 2/6/23 | -50% | 55% |

| Sweetgreen Inc. | SG | 3/13/23 | 45% | -34% |

| Lucid Group* | LCID | 4/10/23 | -23% | 31% |

| Trupanion | TRUP | 5/1/23 | -33% | 38% |

| Overall Portfolio Return | -42% | 54% | ||

Sources: New Constructs, LLC and company filings.

*Stocks removed from the Zombie Stock List. Performance tracked through the date each was removed. Linked report goes to the report in which the stock was removed.

Since our first report on June 23, 2022, the Zombie Stocks have fallen over 42% while the S&P 500 is up 12%. See Figure 9.

Figure 9: Combined Performance of Zombie Stocks List Through 11/6/23

Sources: New Constructs, LLC and company filings.

This article was originally published on November 8, 2023.

Disclosure: David Trainer, Kyle Guske II, Italo Mendonça, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.