WeWork’s Failed IPO Is a Win for Main Street

Main street investors avoided sinking billions of dollars into a value-destroying business while forcing important leadership and governance reforms.

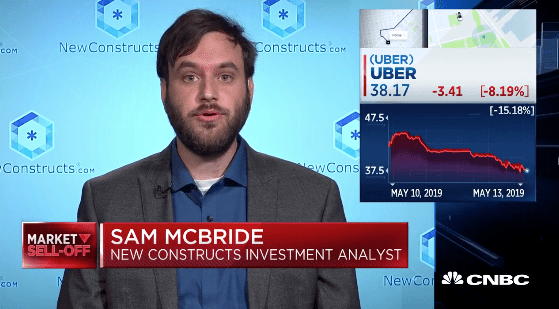

Sam McBride