The market is roaring and setting new highs almost every day. While a rising tide can lift all ships, it can also raise risk because there are many stocks that do not deserve to go up.

This week’s Danger Zone pick does not deserve the recent run up in its stock price. The company continues to burn through cash and has not generated positive Core Earnings in its history.

Don’t get me wrong – this Danger Zone call has been great, even excellent. Since we first put the stock in the Danger Zone, it has outperformed as a short by 92%.

However, the 87% run-up in the stock over the past 60 days has nothing to do with the (very poor) fundamentals of the business. In fact – it’s the opposite…the fundamentals remain terrible and are not much better than when we made the original Danger Zone call.

So, the stock looks crazy expensive, again. How bad could things get? The no-growth value of the business is less than -$13.00/share. We think investors deserve to know about bad stocks like this because they can ruin an entire portfolio. Don’t expect Wall Street to warn you…nearly half the Wall Street Ratings on this stock are “Buy”.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- negative margins and persistent cash burn,

- lack of true competitive advantages, and

- a stock valuation that implies the company will grow gross merchandise volume (GMV) to over half of Amazon’s 2023 GMV.

What’s Working

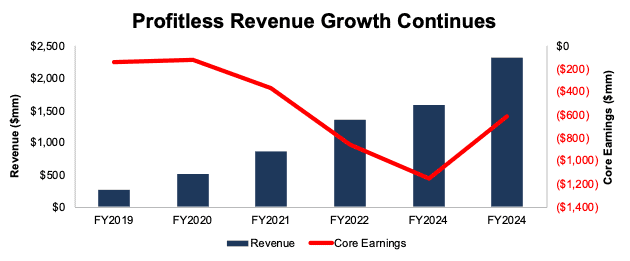

The company has successfully grown the top-line, as revenue has increased year over year (YoY) every year since fiscal 2019 (earliest data available in our system). The company has grown its gross merchandise volume (GMV) 10x from fiscal 2019 to fiscal 2024. In addition, the company’s active consumers grew from 2 million to just under 19 million over the same period.

What’s Not Working

The Company Remains Unprofitable

This company has not generated positive Core Earnings in any fiscal quarter or year of our company model, which dates back to fiscal 2019. Even after improving from record lows in fiscal 2024, Core Earnings sit at -$609 million in fiscal 2024. The company’s net operating profit after-tax (NOPAT) margin and return on invested capital (ROIC) also remain highly negative. The company’s NOPAT margin is -22% and its ROIC is -17% in fiscal 2024.

Figure 2: Revenue and Core Earnings: Fiscal 2019 – Fiscal 2024

Sources: New Constructs, LLC and company filings

Zombie Stocks Are Inherently Risky

Companies with fast-depleting cash reserves are risky investments in any market. These risks are higher when the cost of raising capital increases. When we last wrote about this company, we noted it had just 21 months until running out of cash. The company’s cash burn slowed slightly in fiscal 2024, which lengthens its runway by a few months.

The company now has 24 months of runway from the end of October 2024, based on its two-year average free cash flow (FCF) burn, which is -$943 million. More details in Figure 3 in the full report. The fact remains that, without a significant improvement in operations, this company will need an influx of cash, either through costly debt or dilutive share issuances.

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.