In last week’s letter, I wrote about the value of hard work and how much of it we do at New Constructs. This week, I want to show you how much work we do because you deserve to see it. Every client deserves proof of the value proposition for which they pay. Plus, we are able to show our work transparently – in a way that other research firms cannot. I challenge you to ask your advisors, your research providers, and your money managers to show you their work. One of the things about good fundamental research is that if you do it, you can show it. Just as we have shown in our recent training webinars and showed in the training on Wednesday, May 15, at 5pmET. Replay is here and watch me show you how I find stocks that I would trust with my family’s money. And, I answer any questions about my methods that participants want to ask. Honestly, I will be surprised if every single person that attends that training (live or replay) does not walk away believing in my process and the research that supports it.

Now, I know there will always be haters and, undoubtedly, there will be a few who say they don’t believe simply because they read what I just wrote. So, I should rephrase to “I will be surprised if *nearly* every single person…” The point is when you do the work, one of the many rewards is confidence in your decision making, and we have that confidence. We’re proud of work, and we want our clients to see it.

Given how transparent we are, I find it more than a little odd that so many investors let our competitors get away with not showing their work.

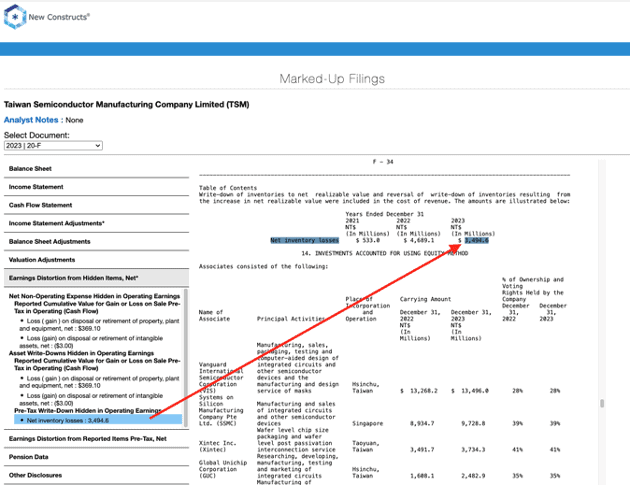

Next, let me show you our Marked-up Filings tool (proof of how it works is here). This tool allows our clients to audit every single data point in our models and analytics. In other words, if you want to audit the accuracy of any of our calculations and/or the data that drive them, you can do so with a few clicks of the mouse. This tool allows clients to verify even the most obscure data that we find in the footnotes. Check out the picture below for an example of how we show exactly where we find an unusual charge buried deep in the footnotes for Taiwan Semiconductor Manufacturing Company (TSM).

Figure 1: A Snapshot from our Marked-up Filings Tool

Sources: New Constructs, LLC

You probably will not be surprised to learn that this tool plays a big role in convincing clients and partners of the superiority of our data, models and ratings. I mean, what is more convincing than being able to audit every data point in a model. And, that’s exactly what the folks at Harvard Business School, Ernst & Young, The Journal of Financial Economics and MIT Sloan did before they published their studies proving the superiority of our data, models and ratings.

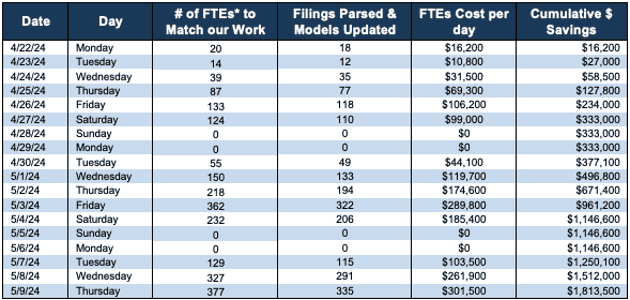

Next, I will share how much work we’ve done in the last few weeks. Per Figure 2, we’ve analyzed over 2,015 financial reports filed with the SEC.

Figure 2: Putting a $ Value on Our Parsing Work for Clients: 1Q24 Filing Season So Far

Sources: New Constructs, LLC

* FTEs = Full Time Employees at $100/hour for 8 hours a day.

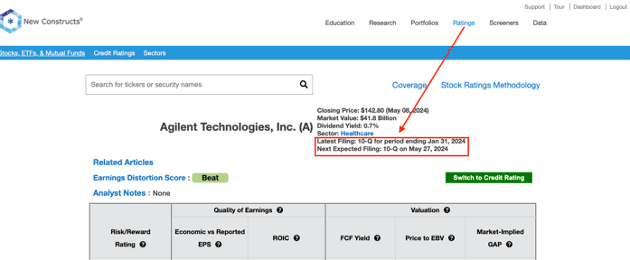

Note that you can verify that we’ve parsed this many filings by using the Marked-Up Filing tool to see the latest fling parsed for every company we cover. Plus, we’re forthright and transparent about the freshness of the data driving our models and ratings for every company as you can see in Figure 3.

Figure 3: Snapshot from our Ratings Page

Sources: New Constructs, LLC

In other words, you can check the freshness date for all of our data, models and ratings anytime, all day every day. Plus, clients get alerts every morning every time we parse a new filing for any of the companies in their portfolio(s).

We built transparency into our platform for a reason – we don’t want to have to hope people will trust us, we want to prove that you should trust us. Trust might be the most important thing you have for the research you use to make investment decisions. I mean, if you can’t trust your research, then you probably shouldn’t be investing anyone’s money, not even your own.

So, we make it easy to audit our data, models and research. We’re 100% transparent because we want you to know how much work we do for you. I’m not sure our competitors can say the same. And, I encourage you to ask them about it. Ask them to show you their work like we do. If they’re doing the work, they shouldn’t mind showing it any more than we do. Right? Why not?

And, if you’d like more proof from us about how much work we do, then please check out our:

- Live training Wednesday, May 15, at 5pm ET: The Stocks I Would Trust With My Family’s Money. Click the button below to watch the replay.

- Free live Podcast every month. We just did one on May 10th at 12pmET. Get the free replay from our Society of Intelligent Investors (use this form to sign up for free) and ask questions and make requests anytime!

- Monthly Let’s Talk Long Ideas webinars where we do deep dives into our research, analytics, reverse DCF models and ideas for our Professional and Institutional clients. We just did one on May 8th at 3:30pmET. Replay is here for our Professional and Institutional clients.

- And, I cannot emphasize enough - BECAUSE NO ONE ELSE CAN DO THIS - the 100% transparency into all models, analytics and data so clients can audit our work anytime via our Marked-up Filings feature.

Diligence matters,

David Trainer

This article was originally published on May 13, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.