Morningstar, one of the best known ETF and mutual fund rating services, has long been the standard in the industry. Morningstar excels at providing research on an enormous amount of funds to an even greater amount of investors.

However, as we have touched on in the past, we believe that Morningstar’s size and stronghold on the rating industry do not always serve investors’ best interests as much as perceived. Changes in Morningstar ratings have been proven to have a large impact on mutual fund in/outflows, and that impact drives some counter-productive behaviors by fund managers looking to make a quick buck at shareholders’ expense.

Funds spend large sums of money and dedicate senior personnel to influence Morningstar analysts and keep their ratings higher as detailed in the Financial Times on 08/21/14. Wall Street has shown us that bad things happen when companies have influence on their stock ratings. Combine the fact that the fund houses pay Morningstar big fees for the rights to advertise their Morningstar rating, and you have more conflicts of interests that make it hard to be sure of the objectivity of MORN’s ratings.

While Morningstar ratings analyze numerous aspects of a fund, such as management experience, overall style, and costs, there is little if any research into the factor that truly drives a funds’ performance: its holdings. How can a rating that doesn’t take into account the true driver of performance (holdings) be counted on to predict future performance?

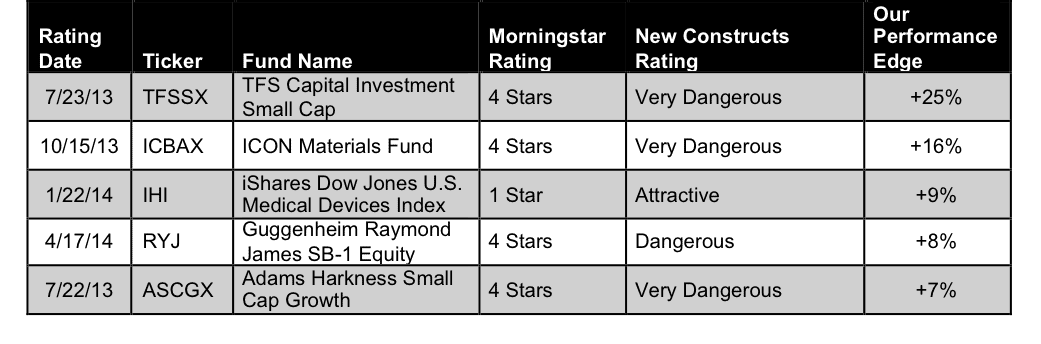

Figure 1 shows a few of the many examples where New Constructs ratings have outperformed Morningstar ratings. Our predictive fund ratings are based on stock ratings of each fund’s holdings, as well as each fund’s total annual costs. These ratings are forward-looking, unlike Morningstar’s, which rely on past performance. We do the necessary homework on funds’ holdings to determine its true risk/reward profile.

Figure 1: Morningstar Ratings vs. New Constructs Ratings

Source: New Constructs, LLC and company filings

Our analysts have uncovered 10 additional funds for which New Constructs’ rating varies greatly from Morningstar’s. Some are funds you may want to own though Morningstar would say otherwise. Six of these funds have received Morningstar’s 5-star rating and may be in danger of the “five-star kiss of death.”

Investors deserve a rating system that is forward-looking, not one that relies too much on past results. At New Constructs, we apply our expert stock analysis to the holdings of mutual funds and ETFs so that investors can make more informed decisions about which fund to buy.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.