Despite over 92% of the 193,000 comment letters opposing delay, the Department of Labor’s Fiduciary Rule has been officially delayed until June 9. No matter the legalities, investor awareness is higher. As Michael Kitces recently tweeted “…Can’t unring this bell now…”

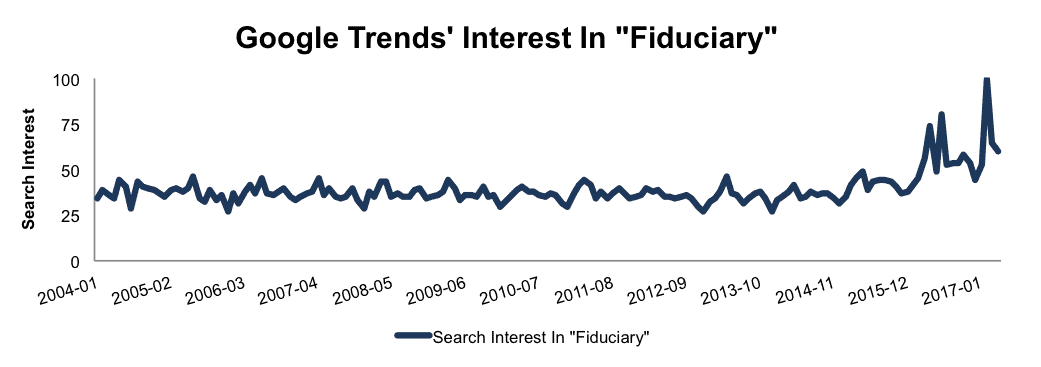

Interest In Fiduciaries Driven To New Highs

Figure 1 provides the data behind the term “fiduciary” reaching all time highs as measured by Google Trends.

Figure 1: Interest In “Fiduciary” Remains Elevated

Major wealth management firms [e.g. Fidelity and Bank of America (BAC)] have announced their intentions to embrace the Fiduciary and show investors they are, unequivocally, dedicated to serving their best interests.

Even if the DoL’s fiduciary rule is cancelled, its impact on the industry is here to stay.

Embrace The Change Or Risk Reputational Damage

Investors are better served, and the investing business has more integrity, when the fiduciary level of service is applied. Investors want advice that is aligned with their best interests. No adviser wants to be perceived as not having the clients’ best interests top of mind.

Fiduciary Duty of Care Is As Important As the Duty Of Loyalty

By law, a fiduciary must act with “care, skill, prudence, and diligence.” To help those not clear on exactly what defines diligence, we define it in this white paper and on the DOL’s website. In short, research that meets the fiduciary duty of care should be 100% un-conflicted and, inarguably, in the best interest of the client.

Technology Is Key Solution To Mandates To Cut Costs And Maintain Quality

In the past, it had been nearly impossible to provide diligence at scale. Today, robo-analyst technology solves the scale challenge and enables a higher level of diligence at such a low cost that ignoring it is unethical.

More of the biggest names in the financial industry, such as BlackRock (BLK) and JPMorgan Chase are embracing technology to improve investment decision-making.

We think investors deserve not only a fiduciary level of service, but also the latest that technology can offer.

This article originally published on April 11, 2017.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.