Our report on Overstated Street Earnings in 1Q24 shows Street Earnings (based on Zacks Earnings) overstate profits for the majority of S&P 500 companies in 1Q24. However, there are 122 S&P 500 companies with TTM 1Q24 Street Earnings that are lower than their true profits, i.e. Core Earnings[1],[2]. These companies are more profitable than investors realize and, in many cases, undervalued as well.

This report shows:

- the magnitude of understated Street Earnings in the S&P 500,

- why Street Earnings (and GAAP earnings) are flawed, and

- five S&P 500 companies with understated Street Earnings and Attractive-or-better Stock Ratings.

122 S&P 500 Companies Have Understated Street Earnings

For 122 companies in the S&P 500, or 24%, Street Earnings are lower than Core Earnings in the trailing-twelve-months (TTM) ended 1Q24. In the TTM ended 4Q23, Street Earnings were understated for 125 companies.

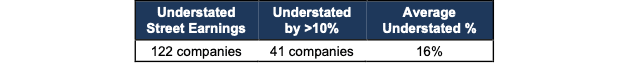

When Street Earnings are lower than Core Earnings, they are understated by an average of 16% per company, per Figure 1.

Figure 1: Street Earnings Understated by 16% on Average in TTM Through 1Q24[3]

Sources: New Constructs, LLC and company filings.

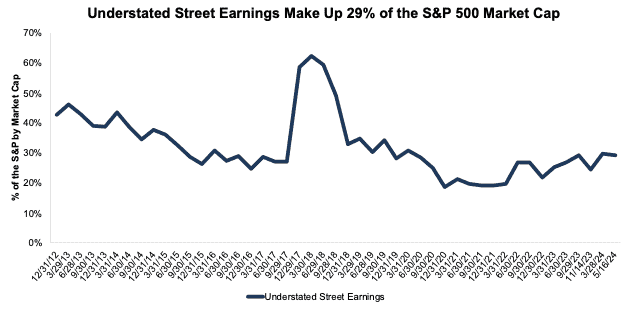

The 122 companies with understated Street Earnings represent 29% of the market cap of the S&P 500 as of 5/16/24, which is down from 30% in the TTM ended 4Q23.

Note that this analysis is based on our team analyzing the financial statements and footnotes for ~3,000 10-Ks and 10-Qs filed with the SEC after earnings season. We estimate that the cost of this work for most firms would be over $2 million each quarter. To say the least, there is tremendous value in our rigorous analysis of these filings across so many companies so that our clients can discern the best and worst stocks with unrivaled diligence.

Figure 2: Understated Street Earnings as % of Market Cap: 2012 through 5/16/24

Sources: New Constructs, LLC and company filings.

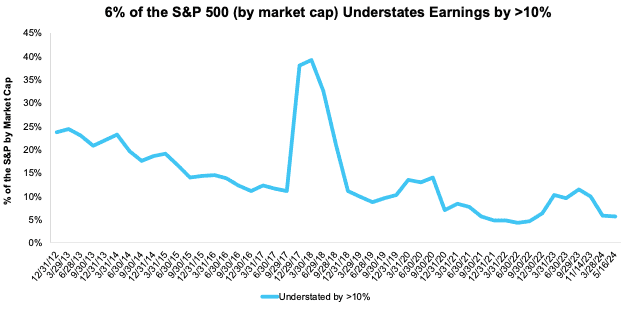

For 41 companies, Street Earnings are understated by more than 10% vs. Core Earnings. These 41 companies make up 6% of the market cap of the S&P 500 as of 5/16/24. See Figure 3.

Figure 3: Understated Street Earnings by 10% as % of Market Cap: 2012 through 5/16/24

Sources: New Constructs, LLC and company filings.

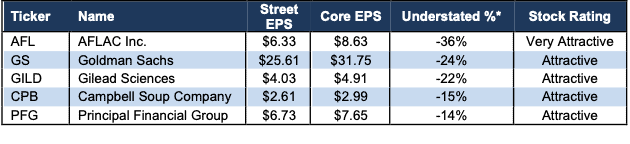

The Five Most Understated Earnings in the S&P 500

Figure 4 shows five S&P 500 stocks with Attractive-or-better Stock Ratings and the most understated Street Earnings (based on Street Distortion as a % of Street Earnings per share) in the TTM ended 1Q24. “Street Distortion” equals the difference between Core and Street Earnings on a per share basis. Investors relying only on Street Earnings miss the true profitability of these businesses.

Figure 4: S&P 500 Companies with Most Understated Street Earnings: TTM 1Q24

Sources: New Constructs, LLC and company filings.

*Measured as Street Distortion as a percent of Street EPS

In the section below, we detail the hidden and reported unusual items that distort GAAP Earnings for Gilead Sciences. All these unusual items are removed from Core Earnings.